![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/7/a/csm_338__EXP__Bruno_Mendes__Spuerkeess_59c18ce92e.jpg)

Are you self-employed in Luxembourg, live there and want to boost your retirement? Do you want to cover yourself and your loved ones against the risk of death or disability? In this article, our expert Bruno Mendes, Business Advisor Coordinator at Spuerkeess, explains why and how you can benefit from a highly advantageous tax framework. Happy reading!

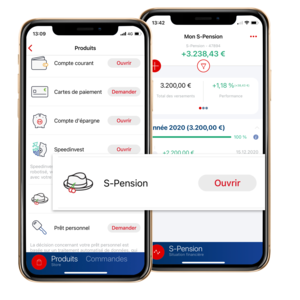

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/6/c/csm_367_FIN_S-Pension_non_residents__1__7ed60e51c2.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/3/1/csm_SP_147_illustrations_blog_janvier_-_epargne_prevoyance_veillesse_jeune_b6e2125af0.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/1/csm_238__STI__Investir_vert_b53c269490.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/f/3/csm_237__STI__Actualites_e1e66ccaf9.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/7/b/csm_definir-sa-strategie-dinvestissement-226_57d91e05c2.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/8/3/csm_225__STI__Profil_d_investisseur_a39e4342fe.jpg)