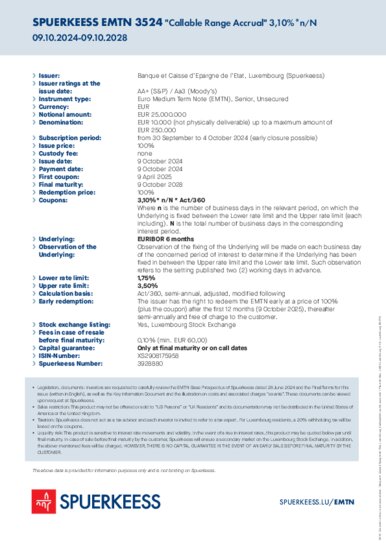

When you buy a structured debt security, you are lending money to the issuer and become a creditor. The potential return depends on the performance of an underlying security, such as an interest rate or a benchmark equity index.

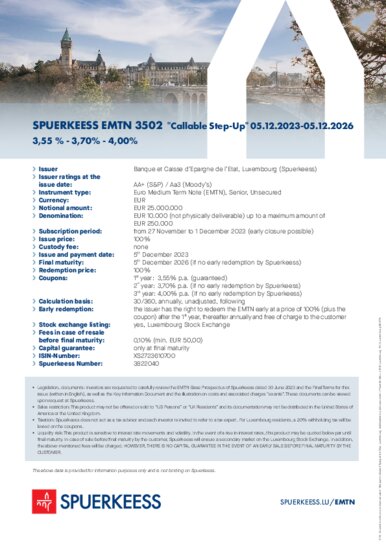

An EMTN (Euro Medium Term Note) is a type of medium-term debt instrument issued in EUR and having a maturity of 1 to 10 years.

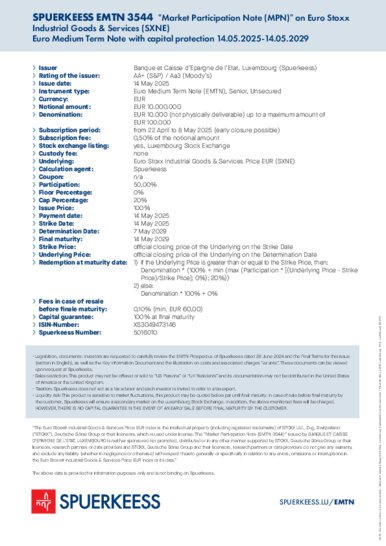

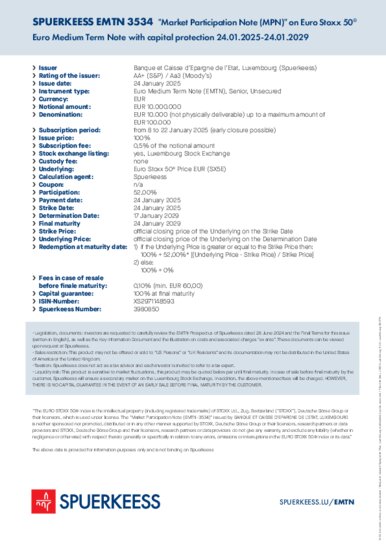

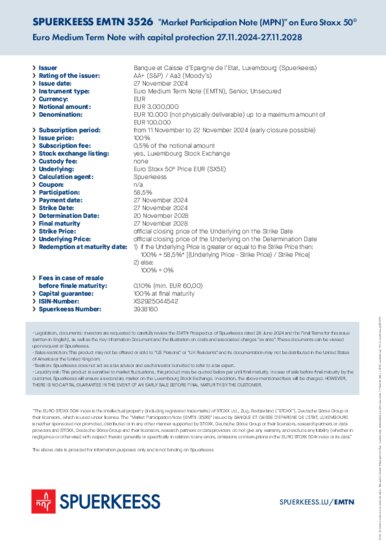

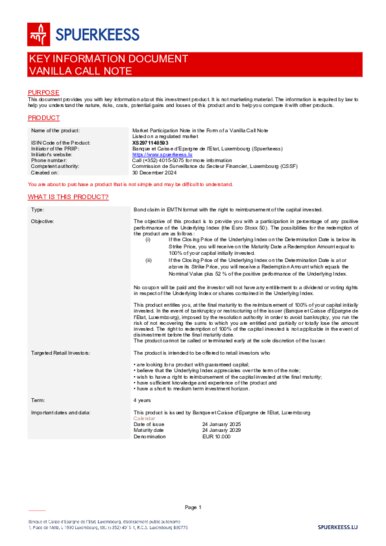

SPUERKEESS EMTN 3544 "Market Participation Note (MPN)" on Euro Stoxx Industrial Goods & Services (SXNE) Euro Medium Term Note with capital protection 14.05.2025-14.05.2029

A ‘Market Participation Note’ (or MPN) EMTN is a debt security, usually with 100% capital protection, which pays a gain at maturity proportional to the positive performance of an underlying asset (share, basket of shares or index). This gain is also known as a ‘participation’ in the performance.

In return for capital protection, participation in the positive performance of the underlying is often only partial. At final maturity, investors receive their capital plus a bonus if the underlying has performed positively since its initial observation level.

In the event of a negative performance of the underlying, the capital invested is repaid in full at final maturity (capital protection).