Information on VoP

-

VoP is mandatory for euro transfers initiated electronically or requested in person at a bank branch. Only TUP payments and payments initiated by letter, fax, or e-mail do not benefit from the additional security that VoP provides. Professional and institutional customers have the option to "opt out" of VoP in the case of multiple transfers submitted via file.

VoP is mandatory for euro transfers between payment accounts at banks in the eurozone starting October 9, 2025, and for all EU banks starting July 9, 2027.

-

According to Regulation (EU 2024/886), VoP is a mandatory service provided by banks. Exemptions are only allowed in two cases:

- Professional or institutional customers can opt out of VoP for bulk transfers submitted via file.

- Non-electronic payments where the customer is not present (TUP and payments via letter, fax, or email).

-

Yes. Make sure the beneficiary name you enter matches the name of the beneficiary’s account.

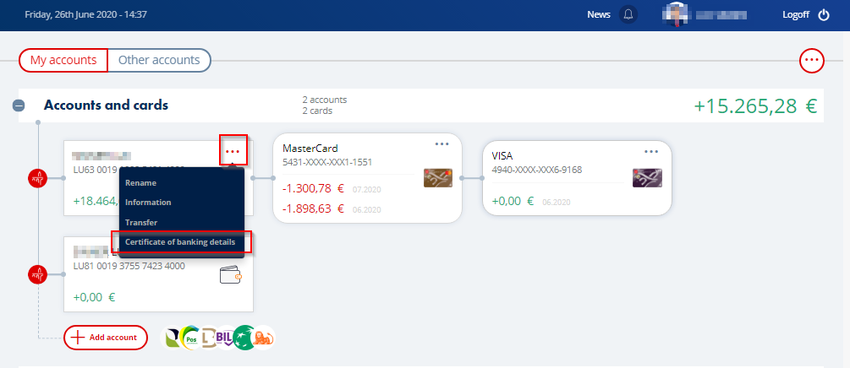

The valid name is the one on the Bank Account Details (RIB) of the beneficiary's account. If no RIB is available, refer to the name next to the IBAN on the invoice. When in doubt, ask the beneficiary for the correct name to use.

To make things easier, remember to update your list of saved beneficiaries!

-

Yes. Payment recipients should ensure their invoices and other documents display the account name near the IBAN. The correct name is the one shown on the RIB of the account to be credited. If needed, please update/complete your invoices and other materials as soon as possible.

Note: This also applies to person-to-person payments! Always provide the account name from your RIB, along with the IBAN, to anyone sending you money.

-

Ensure the beneficiary name you enter matches the one registered on the RIB of the beneficiary account. If not available, use the name shown next to the IBAN on the invoice or payment request. When in doubt, ask the beneficiary for the correct name. Keep your list of saved beneficiaries up to date.

For file-based transfers (e.g., through MultiLine, for salaries), any mismatch detected by VoP may result in all transfers being blocked.

Hence the importance of verifying your saved beneficiaries and considering a VoP opt-out for bulk transfers via file.

-

No. VoP helps verify data consistency — specifically, that the entered name matches the account holder's name. If there is a mismatch, the payer is alerted. The payer can either:

- Correct the data and resubmit the transfer (subject to VoP again), or

- Accept the risk and proceed with the original instruction, possibly sending the money to the wrong person.

-

Every new security measure will encourage criminals to create new fraud scenarios. Please always bear in mind that neither banks nor other payment service providers send messages or e-mails asking you for data. If you receive such messages, they are attempts at fraud. VoP is only carried out on the platforms of banks (e.g. S-Net, S-Net Mobile) or other payment service providers. VoP control is automatic and does not require any specific action on your part.

-

To learn more about instant payments, please click here.

-

Make sure that your mobile phone or tablet has the latest version of S-Net installed so that you can benefit from all the new features, including the VoP service. Go to Google Play or the App Store to check for updates!

No update version is being displayed in your store? Then your smartphone or tablet may no longer be supported by the new technologies. Please contact your mobile phone provider accordingly.

-

If a "Close Match" or "No Match" is detected, you can continue without making any changes if you are sure your data is correct. Simply press the "Check" button. However, we recommend that you first check and, if necessary, correct the name you have entered, based either on the information displayed in S-Net (in the case of a "Close Match") or on reliable information obtained from the beneficiary (in the case of a "No Match"). This will also be useful later on when you enter a new transaction for the same beneficiary.