December’s red to hopeful green

Investment Update - January 2025

December’s red to hopeful green

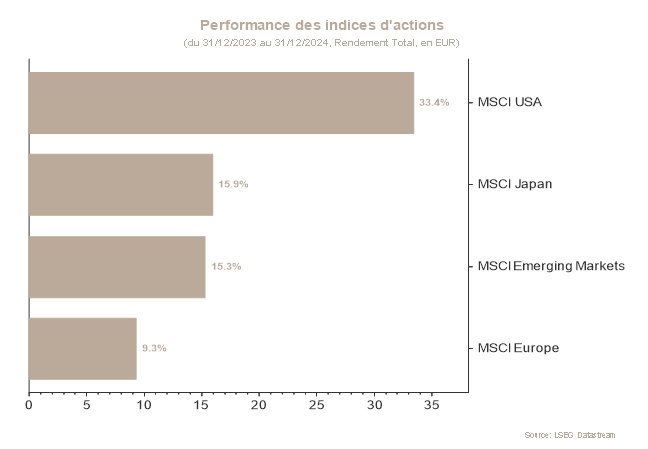

December was the second month to end in the red after April 2024 on the equity markets. This ended a seven-month streak in the green, with the global equities index shedding -0,42%*.

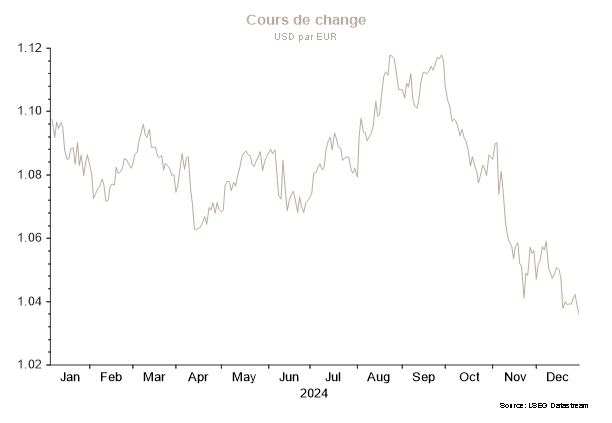

While regional performances were close (-0,49%* for Europe and -0,65%* for North America), the currency effect hid some disparities. The greenback rose nearly 2% against the euro based on the rise in bond yields, and cushioned the poor performance of the US markets for European investors.

In December, the markets experienced two very different periods. Indices were fairly bullish in the first half of the month, continuing the upward trend underway since the US election in early November. In mid-December, performances were quite good, reaching a high of +1.5%*.

That said, the US Federal Reserve (Fed) meeting on 18 December dealt a blow to the markets’ “Christmas rally”. While the Fed cut its rate by another 25 basis points, the market focused instead on the rate cuts planned for 2025, which are now just two instead of four.

Persistent inflation, particularly in the core segment, caused the Fed to be more cautious with regard to future rate cuts. Then there is the uncertainty linked to the economic policies that Donald Trump may implement, which cloud the Fed’s visibility on growth and inflation forecasts. In spite of it all, Fed Chairman Jerome Powell remains particularly attentive to the labour market, justifying the December rate cut and the two cuts planned for 2025.

Naturally, the bond market remained jumpy in this environment characterised by sustained growth, rigid inflation and a high government deficit. Moreover, the US 10-year rate has continued to climb since its September lows, rising from 3.60% to 4.5% in December. There again, the economic and trade policies that Trump promises are driving investors to be more cautious about public finances and inflation, which naturally impacts long-term rates.

Ultimately, the rise of bond yields is one of the main limits that the equity market could face, and partly explains why equities fell in December. High valuations make investors nervous when they are not accompanied by rate cuts. While the Fed has been generous in its rate cuts, which amounted to 100 basis points in 2024, the bond market has shown some reluctance as to the Fed’s ability to continue in this direction. However, Powell made a reassuring statement – that the job market was no longer "a source of broad inflationary pressures for the economy" – and the temperance of employment indicators could limit the rise in yields on the bond market, which would relieve investors on the equity market.

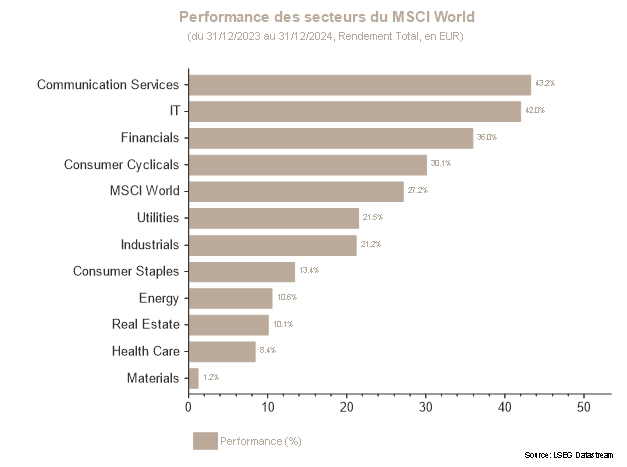

In terms of allocation, the preference was for equities over bonds. The strong economic growth and solid corporate earnings expected in 2025 are raising hopes for this asset class. The only downside: appetite for bonds remains more mixed due to strong economic activity in the United States, persistent inflation and a high government deficit. In Europe, the more complex economic situation is raising the profile of government bonds. In terms of sectors, communication services, healthcare and finance via US banks are overweight.

*Performances are calculated in euros.

Stock markets

In December, the stock markets deviated from their historically bullish trend, mainly reacting to a stance that was more hawkish than expected from Fed Chair Powell. The market was generally down over the period on both sides of the Atlantic, with the exception of a few large-cap growth stocks, as investors focused on consolidating their gains ahead of the new year.

In Europe, fundamentals remained broadly unchanged. Economic indicators continued to point to a slow recovery in the European economy. Meanwhile, the region seems to be entering a more difficult consumption cycle. Momentum remained fragile as investors maintained their wait-and-see attitude, driven by the changes expected in US trade policy. China is not showing any signs of a substantial improvement in its economy at this stage, delaying the impacts expected on European equities.

The strategic allocation remained largely identical over the period, with the notable exception of the tech sector, which was revised down due to valuations deemed excessively high. The marked outperformance of tech stocks in 2024 seems difficult to sustain, exposing them more to the risk of a short-term correction. In a context of persistent uncertainty related to the political agenda of the new US administration’s policy, exposure to the communications services and healthcare sectors, which are characterised by the resilience of their returns, were maintained.

Sovereign rates and credit market

In December, sovereign yields adopted an upward trend in the US and Europe. The movement was much more pronounced in the United States, with the 10-year yield soaring by 40 bips (bp) while the two-year rate rose 9bp. In Europe, on the other hand, the German 10-year yield rose 28bp and the two-year yield climbed 13bp. Moreover, since the beginning of September, yield curves have returned to normal, with the 10-year rate exceeding the two-year rate.

In the United States, the change in yields was largely influenced by the Fed’s monetary policy. The Fed cut its rates again, bringing total cuts to 100bp in 2024. It is now expected that rate cuts will reach only 50bp in 2025, which is less than investors were banking on. As such, the bullish correction in yields continued following the Fed meeting, with the movement starting earlier in the month due to renewed fears over inflation and slightly less accommodative comments from central bankers.

In Europe, the European Central Bank (ECB) cut rates again in December. However, investors were disappointed that it did not adopt a more dovish tone. While communication on the downward rate trajectory is clear, the comments of the ECB President cast doubt on the aggressiveness with which the institution will actually reduce its rates in 2025. Moreover, Christine Lagarde refrained from committing to the scale or speed of future rate cuts. Political turmoil got the better of OATs (French sovereign bonds), which were the biggest losers over the period.

The European credit market ended with a negative performance at the end of December due to the movement in yields. Spreads tightened by 5bp but the movement in yields was more pronounced. In the US, spreads remained unchanged and yields rose significantly, leading to a negative performance over the month.

Despite the recent volatility in yields, we recommend keeping duration close to that of the market.

Disclaimer

The recommendations contained in this document are, unless otherwise expressly stated, those of Spuerkeess Asset Management and are produced by Carlo Stronck, Managing Director & Conducting Officer, Aykut Efe, Economist & Strategist, Amina Touaibia, Portfolio Manager and Martin Gallienne, Portfolio Manager, acting under an employment contract with Spuerkeess Asset Management.

Spuerkeess Asset Management is an entity supervised by the CSSF (Luxembourg’s financial sector supervisory authority) as a UCITS management company able to provide discretionary portfolio management and investment advisory services.

All external sources (financial information systems, Bloomberg and Refinitiv Datastream) are, unless expressly stated in the recommendation itself, deemed reliable, it being understood that Spuerkeess Asset Management cannot, however, fully guarantee the accuracy, completeness or relevance of the information used by these sources. The information may be either incomplete or condensed and cannot be used as the sole basis for valuing securities.

The valuation of financial instruments and issuers contained in this document is based on data provided by Bloomberg. The full description of the valuation method used by Bloomberg is available at www.bloomberg.com.

Any reference to past performances should not be construed as an indication of future performances. The price or value of the investments to which this document refers directly or indirectly may vary at any time against your interests. Any investment in financial instruments entails certain risks of which Spuerkeess (Banque et Caisse d’Épargne de l’État, Luxembourg) has been informed beforehand, such as the loss of the investment made.

With a view to providing these recommendations to Spuerkeess, Spuerkeess Asset Management has verified all relationships and circumstances that could reasonably be likely to undermine the objectivity of the recommendations contained in this document and confirms the absence of interests and conflicts of interest relating to any financial instrument or issuer to which the recommendations relate directly or indirectly, as well as those of the persons involved in producing these recommendations.

Recommendations are made on the date indicated on the first page of the document and were first released on the same date. The recommendations contained in this document may, where applicable, be used and therefore updated when Spuerkeess Asset Management next provides investment advice to Spuerkeess.

All recommendations sent by Spuerkeess Asset Management to Spuerkeess over the past twelve months may be consulted directly and free of charge at Spuerkeess Asset Management’s registered office, 19-21 rue Goethe, L-1637 Luxembourg. The information to be consulted shall include the date of dissemination of the recommendation concerned, the identity of the individual(s) involved in the production of the recommendation, the target price and the relevant market price at the time of dissemination, the direction of the recommendation concerned and the period of validity of the target price or recommendation.

The information contained in this document cannot be used as the sole basis for valuing securities and this document does not constitute an issue prospectus.

This document is for information purposes only and does not constitute an offer or solicitation to buy, sell or subscribe. Spuerkeess Asset Management may not be held liable for any consequences that may result from the use of any of the opinions or information contained in this document. The same is true for any omissions.

Spuerkeess Asset Management does not accept any liability for this document if it has been altered, distorted or falsified, particularly through online use.