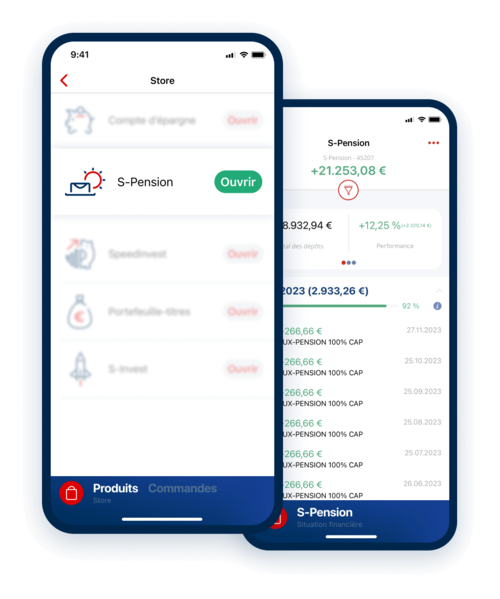

S-Pension: a great plan for the future of all workers in Luxembourg

Halfway through our careers, we look back and wonder why we didn’t think about the future sooner. Did you know that even as a non-resident, you can take out a supplementary pension, with all its benefits? Why is the S-Pension private pension scheme the right choice at this stage in your life?

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/6/c/csm_367_FIN_S-Pension_non_residents__1__7ed60e51c2.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/3/1/csm_SP_147_illustrations_blog_janvier_-_epargne_prevoyance_veillesse_jeune_b6e2125af0.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/4/f/csm_425_FIN_3_raisons_de_faire_sa_declaration_maintenant_3a63d0178a.png)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/7/a/csm_338__EXP__Bruno_Mendes__Spuerkeess_59c18ce92e.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/1/csm_238__STI__Investir_vert_b53c269490.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/f/3/csm_237__STI__Actualites_e1e66ccaf9.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/7/b/csm_definir-sa-strategie-dinvestissement-226_57d91e05c2.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/8/3/csm_225__STI__Profil_d_investisseur_a39e4342fe.jpg)