Relying on fundamentals despite everything

Investment Update - February 2025

Relying on fundamentals despite everything

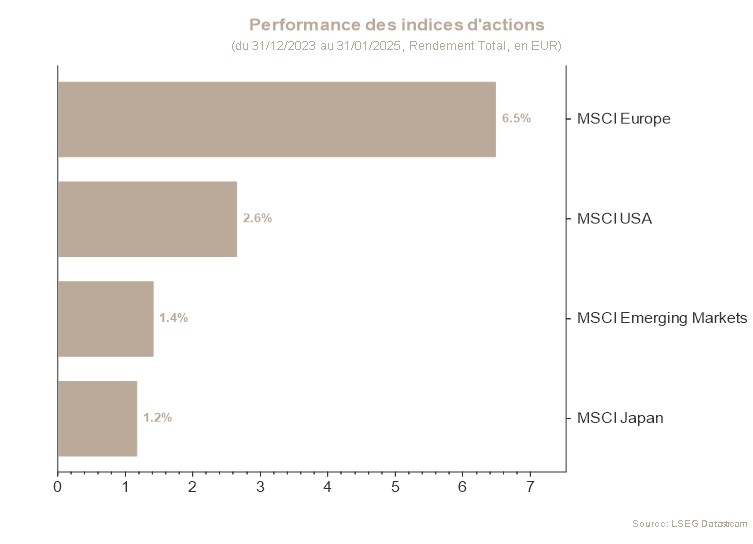

After a slight decline in December, the first month of the year marked the return of risk appetite: global equities posted a performance of nearly 3% in euros. This time, however, contrary to the usual trend, the outperformance comes from European stocks, not American ones.

Indeed, while the US markets gained nearly 2,6%*, Europe significantly outperformed, reaching nearly 6,5%*.

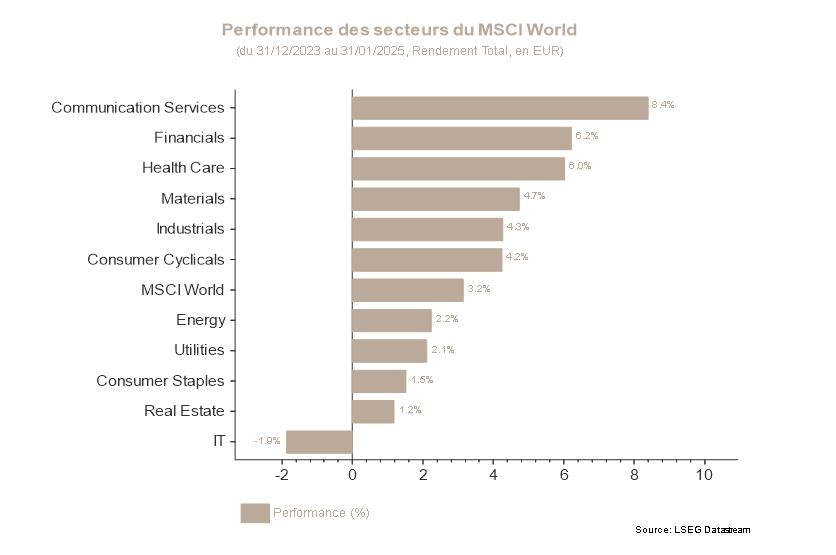

Why did the trend reverse in January? The low valuation of European equities and the lower exposure to technology compared to the US were two positive factors for European stocks. Meanwhile, US equities, especially those in the Technology sector, suffered episodes of stress, particularly linked to the rise in popularity of DeepSeek, the new Chinese artificial intelligence that is undermining US tech giants and calling into question the astronomical spending on artificial intelligence until now.

The rise in popularity of DeepSeek, released as a more comprehensive and especially much cheaper model than ChatGPT, literally shook up the industry, leading to a reconsideration of the whole topic of artificial intelligence that lasted several days. The cost of training this new AI, which according to its developers would amount to just USD 6 million, has cast doubt on the billions of dollars invested by all US tech giants in the AI race, and consequently on the high valuations of these companies.

Although the markets finally managed to put things into perspective after a few days, Donald Trump’s return to the White House generated a new wave of volatility. His announcements of imminent tariffs of 25% on Canada and Mexico, and of 10% on China--all of the United States’ main trading partners--caused a wave of panic in the equity markets. However, after a few hours, the markets regained their calm as the application of these tariffs was postponed by a month. The Canadian and Mexican governments announced increased border controls to curb both illegal immigration and the entry of fentanyl into the US.

Europe, for now, has been spared. However, we expect the Old Continent to also become the target of such announcements in the coming weeks or months.

The current environment is highly uncertain: from one day to the next, higher tariffs are likely to be applied and subsequently revoked. This, of course, makes investors nervous.

Fortunately, the market has been able to focus on fundamentals, which remain strong on both the macro and corporate fronts. Economic figures still demonstrate good resilience, and US companies continue to show solid profitability.

Throughout the Trump 2,0 administration’s term, the markets’ challenge will be to navigate beyond the effects of announcements that may fall like a blow and fade after a few days, as was the case in January. Admittedly, these announcements tease economic scenarios by making them more uncertain, but the initially destabilising effects are still being counterbalanced by the solidity of fundamentals.

In conclusion, the overall allocation continues to recommend an overweight to equities, still favouring US equities that benefit from a healthy economy. On the contrary, the threat of tariffs, which weighs on the rest of the world, greatly reduces visibility for these economies. In addition, sector allocation, in line with an encouraging view on the US economy, highlights sectors such as US banks, Consumer Discretionary, Communications Services and European Real Estate (based on more marked rate cuts in Europe).

*Performances are calculated in euros.

Stock markets

2025 has begun with an upward trend on the global markets, supported by a strong earnings season, particularly in the US, and robust growth accompanied by a favourable monetary policy with a drop in interest rates, particularly in Europe. For once, the European market clearly outperformed the US stock markets: the MSCI Europe gained 6,50% at the end of the month, while the MSCI North America posted a performance of only +2,34% in EUR.

In the US, half of the S&P500 has already published its results in January, and earnings are above expectations on average. The message from companies is generally positive in terms of outlook. From a sector point of view, financial companies posted the strongest performance on the US market, driven by solid results and hopes of deregulation generated by the new Trump administration. The Technology sector struggled more, after an excellent year in 2024. Indeed, the successful launch of the Chinese artificial intelligence platform DeepSeek generated doubts about potential over-investment by US companies, and triggered a sell-off in the sector.

At the end of December, exposure to the Technology sector was reduced while exposure to the European Real Estate sector was increased. This sector, which is currently undervalued, should benefit from controlled inflation in Europe as well as from rate cuts. The exposure to the Communications Services sector was maintained. In addition, the Consumer Discretionary sector, which relies on a healthy US consumer, was overweight. Conversely, caution remains warranted on the Basic Materials and Energy sectors.

Sovereign yields and the credit market

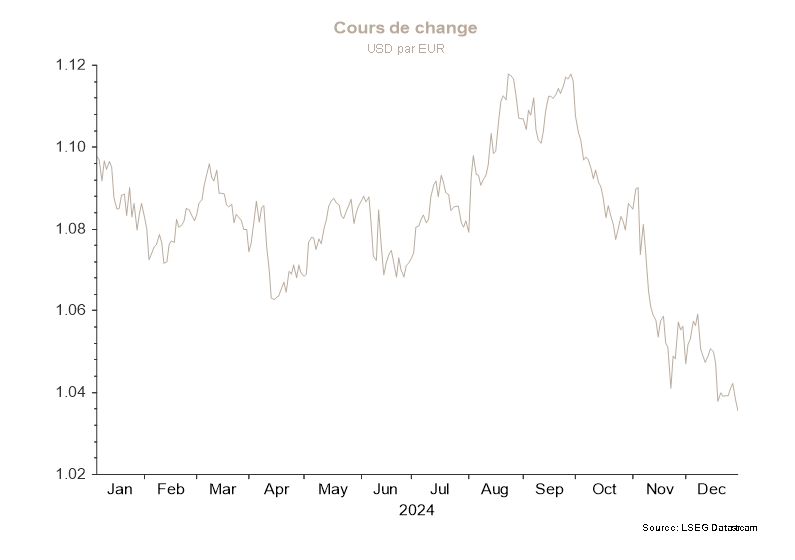

In January, sovereign rates initially continued their upward trajectory that began in December, then reduced their losses in the second half of the month. All in all, January ended with rates up in Europe and down slightly in the US. In the US, the 10-year lost 4bp while the 2-year lost 3bp. In Europe, the German 10-year rate rose by 6bp and the 2-year rate was unchanged.

In the US, inflation concerns were at the forefront of investors’ minds at the beginning of the month. The potential introduction of tariffs by the new Trump administration and a number of economic data pointing to the resilience of the US economy pushed bond yields sharply higher, with investors becoming much more sceptical about the prospect of new Fed rate cuts. However, these movements began to reverse after inflation figures turned out to be not as bad as investors feared. There was then increased hope that the Fed would make further rate cuts this year, a sentiment that Christopher Waller, the Fed’s governor, officially supported by stating his openness to a rate cut as early as March if the data allowed.

In Europe, yields followed the upward trend initiated in the US in the first half of the month. While investors have no doubt that the European Central Bank’s next actions will involve cuts in its key rate, the magnitude of the cuts has been revised downwards. Overall, the latest economic publications highlight a sluggish economy, point to a deceleration in inflation, and arrive along with reassuring comments from the ECB at the end of its last meeting: all elements that point to further cuts in the key rate over the coming months.

European credit ended the month on a positive note. Spreads tightened as expectations of a more accommodative monetary policy from the ECB overshadowed concerns about economic growth, threats of tariffs by the US and rate hikes earlier in the year. In the US, spreads did not move during the month, remaining anchored at historically low levels.

Despite the recent volatility in yields, we recommend keeping duration close to that of the market.

Disclaimer

The recommendations contained in this document are, unless otherwise expressly stated, those of Spuerkeess Asset Management and are produced by Carlo Stronck, Managing Director & Conducting Officer, Aykut Efe, Economist & Strategist, Amina Touaibia, Portfolio Manager and Martin Gallienne, Portfolio Manager, acting under an employment contract with Spuerkeess Asset Management.

Spuerkeess Asset Management is an entity supervised by the CSSF (Luxembourg’s financial sector supervisory authority) as a UCITS management company able to provide discretionary portfolio management and investment advisory services.

All external sources (financial information systems, Bloomberg and Refinitiv Datastream) are, unless expressly stated in the recommendation itself, deemed reliable, it being understood that Spuerkeess Asset Management cannot, however, fully guarantee the accuracy, completeness or relevance of the information used by these sources. The information may be either incomplete or condensed and cannot be used as the sole basis for valuing securities.

The valuation of financial instruments and issuers contained in this document is based on data provided by Bloomberg. The full description of the valuation method used by Bloomberg is available at www.bloomberg.com.

Any reference to past performances should not be construed as an indication of future performances. The price or value of the investments to which this document refers directly or indirectly may vary at any time against your interests. Any investment in financial instruments entails certain risks of which Spuerkeess (Banque et Caisse d’Épargne de l’État, Luxembourg) has been informed beforehand, such as the loss of the investment made.

With a view to providing these recommendations to Spuerkeess, Spuerkeess Asset Management has verified all relationships and circumstances that could reasonably be likely to undermine the objectivity of the recommendations contained in this document and confirms the absence of interests and conflicts of interest relating to any financial instrument or issuer to which the recommendations relate directly or indirectly, as well as those of the persons involved in producing these recommendations.

Recommendations are made on the date indicated on the first page of the document and were first released on the same date. The recommendations contained in this document may, where applicable, be used and therefore updated when Spuerkeess Asset Management next provides investment advice to Spuerkeess.

All recommendations sent by Spuerkeess Asset Management to Spuerkeess over the past twelve months may be consulted directly and free of charge at Spuerkeess Asset Management’s registered office, 19-21 rue Goethe, L-1637 Luxembourg. The information to be consulted shall include the date of dissemination of the recommendation concerned, the identity of the individual(s) involved in the production of the recommendation, the target price and the relevant market price at the time of dissemination, the direction of the recommendation concerned and the period of validity of the target price or recommendation.

The information contained in this document cannot be used as the sole basis for valuing securities and this document does not constitute an issue prospectus.

This document is for information purposes only and does not constitute an offer or solicitation to buy, sell or subscribe. Spuerkeess Asset Management may not be held liable for any consequences that may result from the use of any of the opinions or information contained in this document. The same is true for any omissions.

Spuerkeess Asset Management does not accept any liability for this document if it has been altered, distorted or falsified, particularly through online use.