The return of buyer confidence

The start of the year confirms a promising trend: buyers are returning. The number of prospects on properties for sale increased by 50% compared to early 2024, and by 150% compared to 2023. This renewed interest, supported by price stabilisation, is a key indicator of the market’s recovery. It reflects consumers’ desire to reposition themselves and explore their options again. This is the first important step towards rebalancing the market.

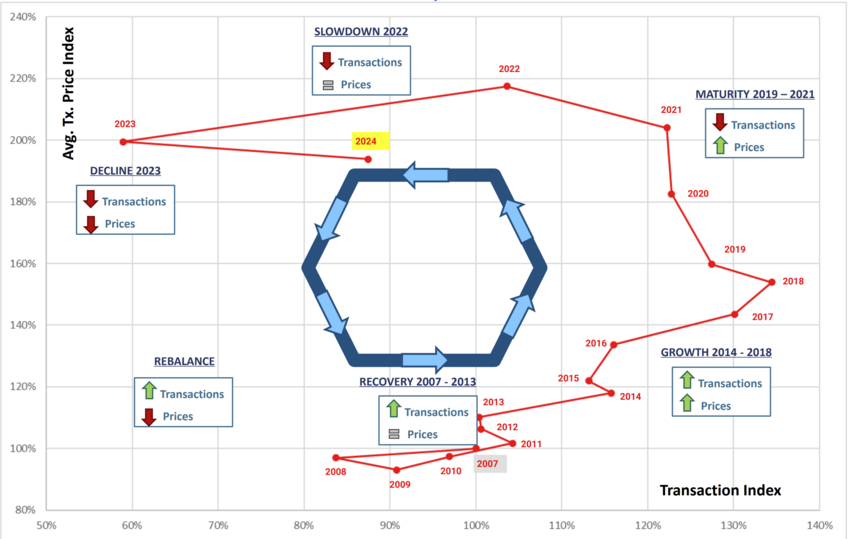

Where are we in the market cycle?

With the support of our data experts, we continuously analyse trends in European and international real estate markets. Our objective is to better understand and anticipate likely and potential changes in the real estate market in Luxembourg.

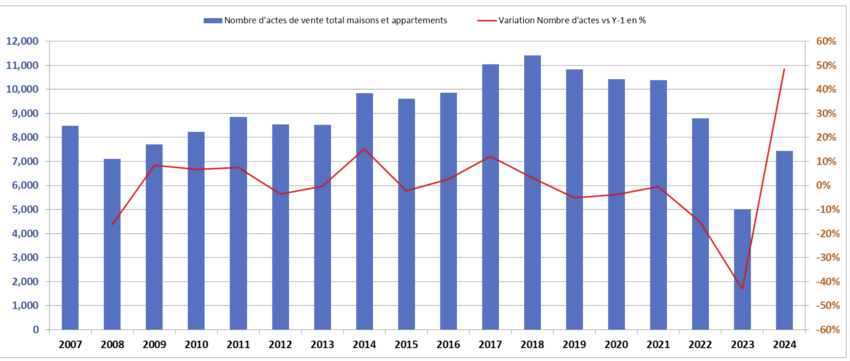

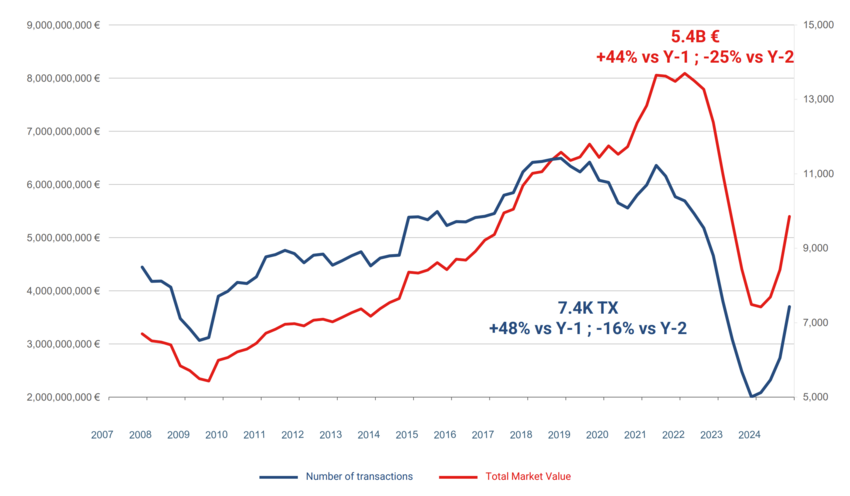

Since 2007, the Luxembourg real estate market has followed a classic pattern, passing through the first three phases of its cycle – recovery, growth and maturity – each lasting several years. However, this steady progression was abruptly interrupted by an accelerated transition to the subsequent phases.

In fact, the phases of slowdown and decline were particularly brief, lasting just one year each. This anomaly can be attributed to the sharp rise in interest rates, an external and sudden factor that put intense pressure on the market.

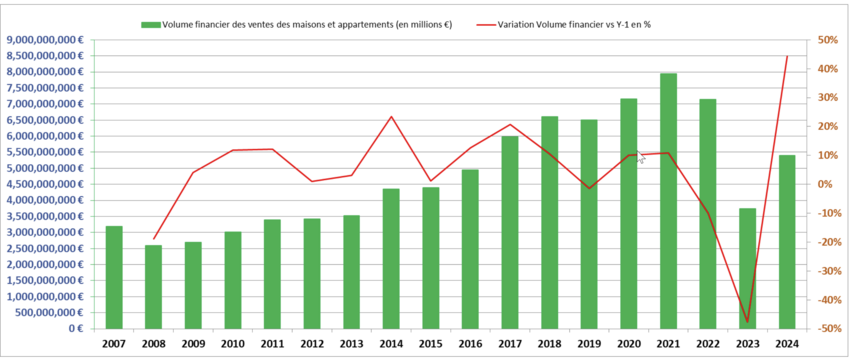

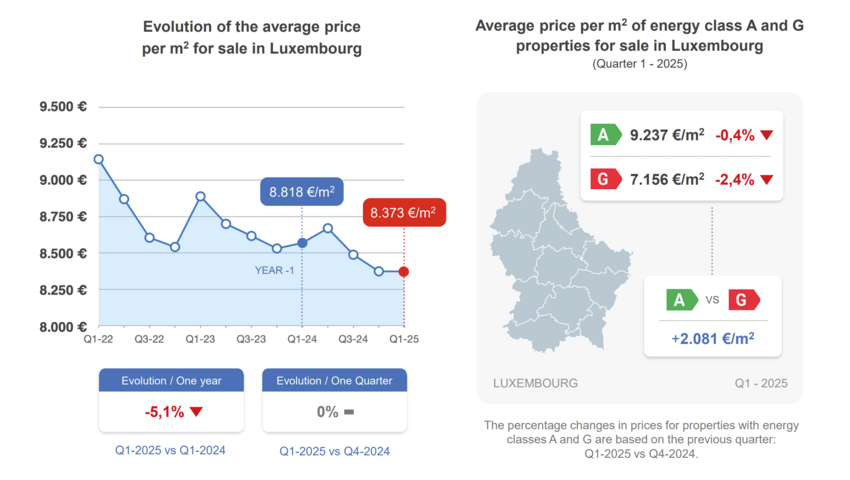

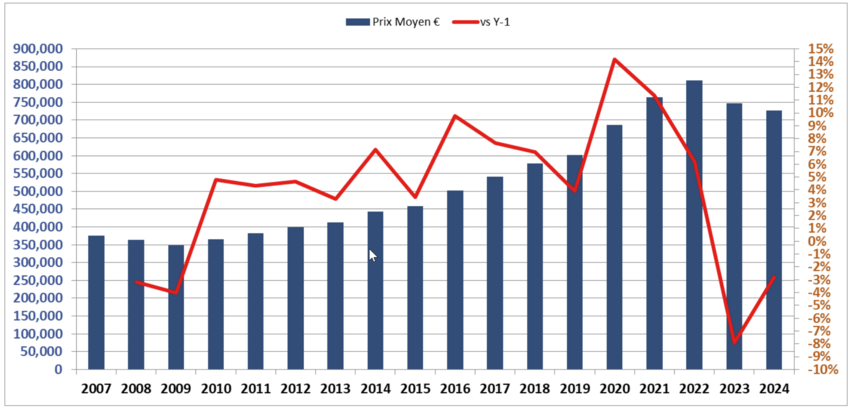

As anticipated in our previous analyses, the cycle bottomed out in 2023. 2024 marked the start of a new phase of rebalancing. This resulted in a decrease in the average transaction price, making the market more accessible and stimulating buyer interest, which contributed to a significant increase in the number of sales.

In 2024, the average price of transactions was €727.000, a decrease of €21.000 (-3%) compared with 2023, and €85.000 (-11%) compared with 2022. This price correction enabled the market to regain its attractiveness, paving the way for a gradual resumption of activity.

In this context of transition, it is reasonable to expect real estate developers and construction companies to adapt their offer to the new market reality. This will include the development of more compact housing, better calibrated to meet household expectations in terms of accessibility and budget.

It seems unlikely that prices per square metre will return to pre-2010 levels. The Luxembourg real estate cycle is more like an upward spiral, marked by successive phases but generally oriented towards long-term value growth. The next stage expected is one of recovery, which we expect as early as 2025, with relatively stable prices and slightly higher transactional activity.

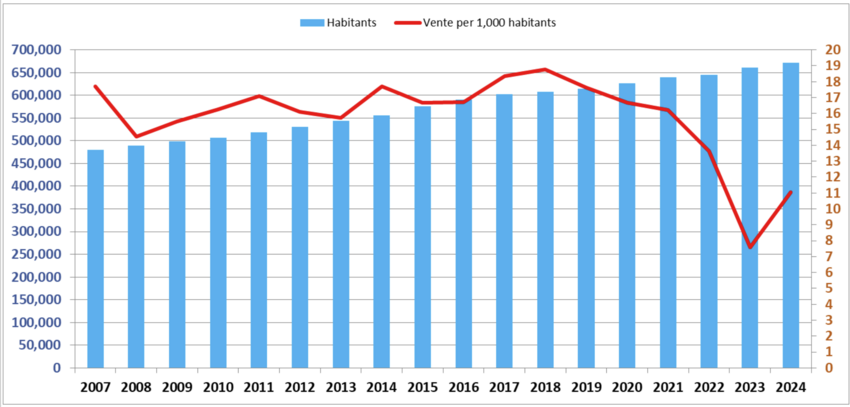

With this in mind, we remain resolutely optimistic, as all indicators point to a gradual recovery and a return to market attractiveness in the coming years. In the longer term, there is a real potential to return to a level of dynamism comparable to that of 2014-2019, during which there were between 16 and 19 sales per 1.000 inhabitants. This indicator, which fell to 7,6 in 2023, has already picked up again in 2024 to reach 11,1 transactions per 1.000 inhabitants, a signal consistent with the current rebalancing phase.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/4/7/csm_438_EXP_Julien_Kohn_Spuerkeess_9001fc61ae.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/c/3/csm_437_EXP_David_Schmit_Spuerkeess_6beedf10c9.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/6/7/csm_433_EXP_Francesco_Ferrero_LIST_31171ca1b1.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/d/1/csm_434_EXP_Nicolas_Griedlich_Deloitte_f84788af86.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/0/d/csm_435_EXP_Rachid_M_haouach_Spuerkeess_6aout25_4132487c59.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/0/6/csm_431_EXP_Claude_Wurth_Spuerkeess_7146fed026.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/7/5/csm_368_EXP_Alternatives_epargne_Pro_c96f107bd8.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/0/d/csm_392_EXP_Michel_MARX_189a526800.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/d/csm_328__EXP__Andrea_Maramotti__Immotop_163f2ecbe1.jpg)