A December without fanfare, but a dynamic year

Investment Update - January 2026

December 2025 ended without the usual Christmas rally in the financial markets. For once, the overall index posted an uninspiring performance of -0,15%*. The last month of the year was divided into two distinct phases: a decline then a final rally. While sparks were lacking at the very end of the year, 2025 nonetheless ended on a strong note, with global equity markets gaining nearly 8%*. They turned in a good performance overall, particularly in Europe.

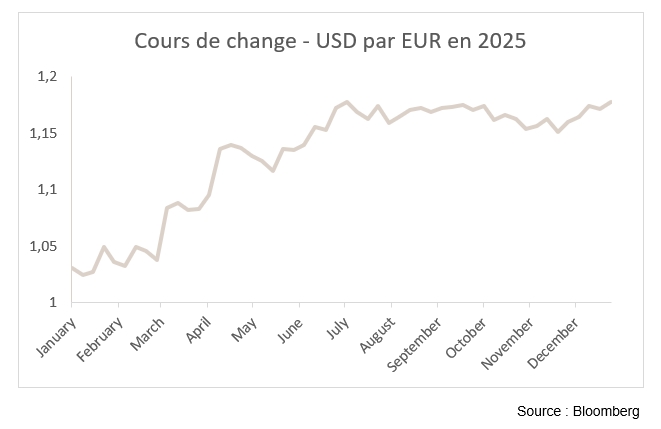

However, there was a clear divergence in regional performance in December. This time, the US markets lagged (-1%*), while European and emerging markets fared well, gaining 2,67%* and 1,82%* respectively. Investors seem to be diversifying their portfolios after focusing for so long on the US markets, which have been driven by tech stocks and the artificial intelligence theme for several years now.

Economic data released in December confirmed the favourable scenario in the United States as the latest estimates put economic growth above expectations while inflation slowed sharply. The second estimate for third quarter growth came out well ahead of expectations, at 4,3%, while the consensus put annualised growth at 3,3%. Surprisingly strong growth in private consumption (3,5% versus a consensus of 2,7%) also allayed recent fears about its trend going forward.

Investors focused their attention on inflation, not hiding their concerns about the absence of data during the government shutdown. In November, inflation finally came out at "only" 2,7%, well below expectations of 3,1%. This reflects a month of rapid convergence towards the 2% target and seems to confirm the idea that the inflationary effect of tariffs is gradually fading.

Lastly, in the United States, the unemployment rate continued to rise slightly, reaching 4,6%. While the trend is worrying, the rise is only gradual, easing fears of a recession in the short term.

Against this backdrop, the Fed's latest rate cut decision in December was a close call. While the rise in unemployment was behind this decision, some Fed members expressed their discomfort at cutting rates while inflation is well above the target. For this reason, any forthcoming rate cuts will be decided with caution.

In Europe, activity picked up again in the third quarter, bringing growth to 0,3%. Private consumption and public spending have made economic activity more dynamic. Inflation stands at 2,1%. However, this alone was not enough for the European Central Bank (ECB) to resume its rate cuts. For the moment, it is satisfied with its position and has even sent out messages of caution regarding expectations of rate cuts.

With this in mind, sovereign yields rose overall over the month. For example, the US 10-year rate rose from 4,02% to 4,17%, while its German counterpart rose from 2,69% to 2,85%.

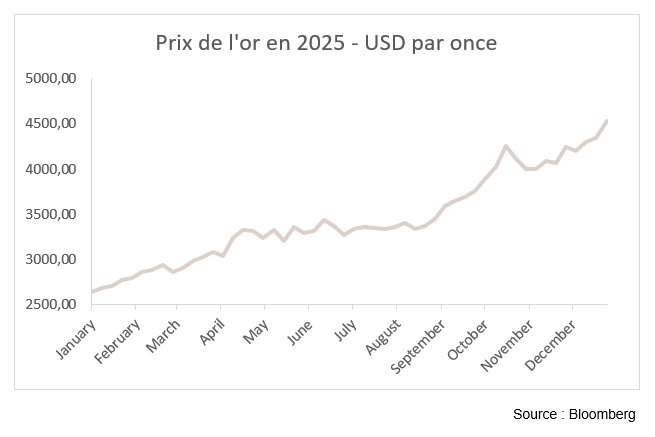

Geopolitics once again took centre stage at the start of the new year with the overthrow of the Maduro regime in Venezuela. The energy sector is expected to see the biggest impact due to the country's considerable reserves: the potential lifting of political sanctions and infrastructure renewal could add Venezuelan oil to global supply.

We adopted a pro-risk allocation for the end of 2025 and the new year: equities are overweighted, particularly via the United States and emerging markets, which provide exposure to the artificial intelligence theme. Biotechnology and US banks are among our

preferred segments. Bonds are underweight overall, with a preference for carry via corporate debt over sovereign rates and duration.

*Performances are calculated in euros.

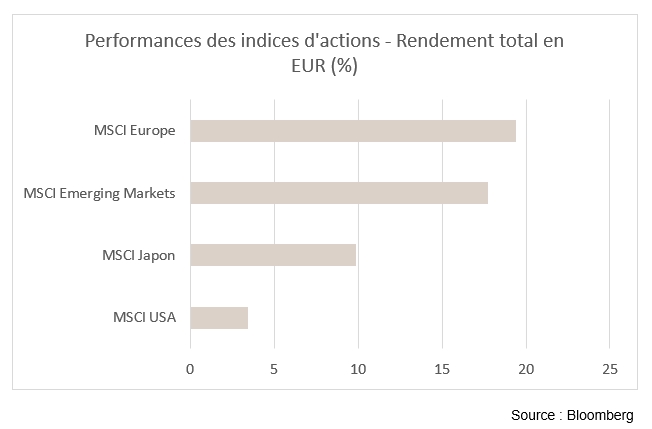

Stock markets

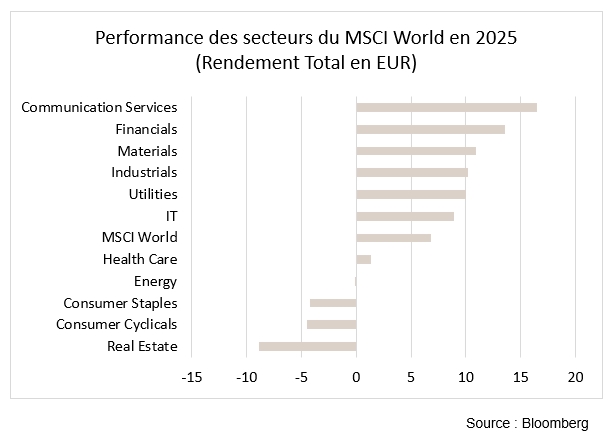

At 31 December 2025, the performance of international equity indices was stable, contrasting with the strong momentum seen in 2025. The European benchmark index closed up +20,2%*, the Chinese index was up +15,9%* and the emerging markets index rose +18,5%*. The negative impact of the dollar's decline over the year led to a -4,5%* fall in the MSCI North America.

Underpinned by a favourable domestic environment in December, European markets topped the leader board with a gain of 2,7%*. The emerging markets index followed with 1,84%* while the US stock market posted a 1% decline due to doubts about the monetisation of artificial intelligence. The much-hoped-for year-end rally failed to materialise, and there were no surprises from the main central bank meetings. The weak rally was reflected in sector dynamics, with investors increasingly exiting tech-heavy indices and redirecting flows to cyclical value sectors, amid low trading volumes.

In Europe, positive trends were observed in Basic Resources, which stood out with a gain of 10,3%. Positive momentum was driven by strong data from sector majors. Industrials also rose, adding 3,2%. The banking sector was a winner on both sides of the Atlantic, posting a 7,9% gain in Europe and 5,6% in the US.

Although corporate fundamentals are still on track, with solid earnings trends in the US, there was no substantial change in macroeconomic data, leading to continued caution in market positioning. Against this backdrop, the Materials and Industrial sectors posted gains of 3% and 0,8%, respectively.

There were no sector reallocations in December.

*Performances are calculated in euros.

Sovereign yields and credit market

December saw the return of volatility on the bond markets amid persistent tensions at the long end of sovereign curves. Early in the month there was global tension on yields, amplified by expectations of monetary tightening by the Bank of Japan. As a result, the markets fluctuated in line with US macroeconomic data and statements from central bank members before stabilising in reduced volumes at the very end of the period.

In the United States, the Fed made a third consecutive 25 bp rate cut, bringing the target range of its key rate to 3,50%–3,75%. While this decision had been largely priced in, Jerome Powell stressed that monetary policy was now close to neutral, paving the way for a pause at the beginning of 2026. The US 10-year yield rose over the month, ending the year at 4,17%, compared with 4,02% at the beginning of December and 4,56% at the beginning of the year.

In the eurozone, the sovereign markets also suffered from the rise in premiums at the global level as well as the ECB's wait-and-see stance. Comments by a member of the ECB, explicitly mentioning the possibility of a future rate hike, triggered tension at the long end, catapulting the 10-year Bund up to 2,85% at the end of the month, compared with 2,68% on 1 December and 2,36% at the beginning of the year.

In the credit segment, December was constructive. Despite the rise in sovereign yields and a somewhat more restrictive monetary stance, spreads continued to tighten on both sides of the Atlantic. Performance was particularly strong in Europe, with investment grade and high yield spreads ending the year at 77 bp and 278 bp respectively, down 24 bp and 37 bp over the year. In the US, the movement was more limited but still favourable: investment grade spreads closed the year at 77 bp (-2 bp) while high yield spreads narrowed by 20 bp to 267 bp.

Disclaimer

The recommendations contained in this document are, unless otherwise expressly stated, those of Spuerkeess Asset Management and are produced by Carlo Stronck, Managing Director & Conducting Officer, Aykut Efe, Economist & Strategist, Amina Touaibia, Portfolio Manager and Martin Gallienne, Portfolio Manager, acting under an employment contract with Spuerkeess Asset Management.

Spuerkeess Asset Management is an entity supervised by the CSSF (Luxembourg’s financial sector supervisory authority) as a UCITS management company able to provide discretionary portfolio management and investment advisory services.

All external sources (financial information systems, Bloomberg and Refinitiv Datastream) are, unless expressly stated in the recommendation itself, deemed reliable, it being understood that Spuerkeess Asset Management cannot, however, fully guarantee the accuracy, completeness or relevance of the information used by these sources. The information may be either incomplete or condensed and cannot be used as the sole basis for valuing securities.

The valuation of financial instruments and issuers contained in this document is based on data provided by Bloomberg. The full description of the valuation method used by Bloomberg is available at www.bloomberg.com.

Any reference to past performances should not be construed as an indication of future performances. The price or value of the investments to which this document refers directly or indirectly may vary at any time against your interests. Any investment in financial instruments entails certain risks of which Spuerkeess (Banque et Caisse d’Épargne de l’État, Luxembourg) has been informed beforehand, such as the loss of the investment made.

With a view to providing these recommendations to Spuerkeess, Spuerkeess Asset Management has verified all relationships and circumstances that could reasonably be likely to undermine the objectivity of the recommendations contained in this document and confirms the absence of interests and conflicts of interest relating to any financial instrument or issuer to which the recommendations relate directly or indirectly, as well as those of the persons involved in producing these recommendations.

Recommendations are made on the date indicated on the first page of the document and were first released on the same date. The recommendations contained in this document may, where applicable, be used and therefore updated when Spuerkeess Asset Management next provides investment advice to Spuerkeess.

All recommendations sent by Spuerkeess Asset Management to Spuerkeess over the past twelve months may be consulted directly and free of charge at Spuerkeess Asset Management’s registered office, 19-21 rue Goethe, L-1637 Luxembourg. The information to be consulted shall include the date of dissemination of the recommendation concerned, the identity of the individual(s) involved in the production of the recommendation, the target price and the relevant market price at the time of dissemination, the direction of the recommendation concerned and the period of validity of the target price or recommendation.

The information contained in this document cannot be used as the sole basis for valuing securities and this document does not constitute an issue prospectus.

This document is for information purposes only and does not constitute an offer or solicitation to buy, sell or subscribe. Spuerkeess Asset Management may not be held liable for any consequences that may result from the use of any of the opinions or information contained in this document. The same is true for any omissions.

Spuerkeess Asset Management does not accept any liability for this document if it has been altered, distorted or falsified, particularly through online use.