Technology, particularly digital technology, is an inherent part of our daily lives now and is used for many different purposes - administration, management of bank accounts, online purchasing, medical treatment, entertainment activities and just simple communication and sharing with our friends and family.

Although the younger generations use new technologies on a daily basis, older people, i.e. those aged 50 or over, are often considered to be disconnected.

But is this a reality or a prejudice, when the use of technology is becoming increasingly prevalent, even unavoidable, in our societies, whether in our relationships or at the administrative and professional level?

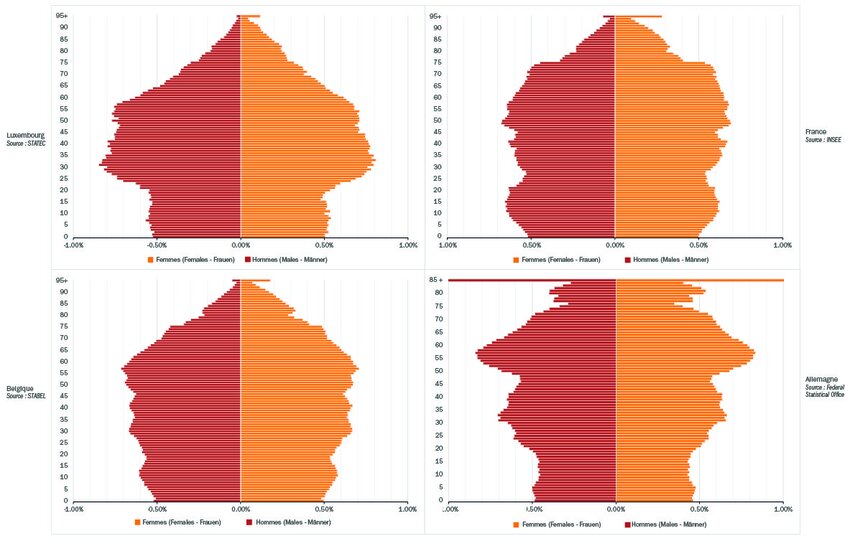

Data from the eighth SHARE survey (http://share.liser.lu/), conducted in 2020, allow us to determine whether senior citizens living in Luxembourg are familiar with, or at least users of, technology.

In Luxembourg, 76% of the over-50s use the Internet to send emails, look for information, make online purchases and various other things. Older people are fully aware of the interest of digital tools and use them for work as well as to communicate and make their daily lives easier. This interest was especially reinforced during the COVID-19 pandemic.

However, use of digital tools decreases gradually with age: 93% of people aged between 50 and 54 use the Internet regularly, 84% of those aged 55-59 and 70% of those aged 60-64, vs. 34% of those aged over 65.

Thus, interest in and use of technologies seems to indeed be a question of generation. However, the question is not necessarily related to the interest that these technologies might have for older people, but rather to their ability to use them.

The proportion of users of digital tools is much higher among working seniors (94%) than among those who are retired (76%) or at home (71%).

Professional activity seems to be a key to entry into the world of technology.

Indeed, 75% of retired people who use technology already used it in their last job. Conversely, three-quarters (73%) of retirees who did not use technology in their last job still do not use it today.

This means that working has enabled older people to become familiar with technology and they keep using it because of the interest it offers. On the other hand, those who do not use technology claim to have only acceptable computer skills or a vague knowledge of these tools. The majority of the latter have not been familiar with computers or similar tools. Moreover, one in two of those who do not use technology (70% for the over-65s) say they have never used a computer.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/7/csm_426_EXP_Romy_Reding_Spuerkeess_28mars25_f6a6df7a8f.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/5/8/csm_SP_175_Illustration_422_EXP_Bertrand_Lathoud_Luxembourg_House_of_Cybersecurity_d8f6d97d0e.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/f/5/csm_SP_171_Illustration_420_EXP_Philippe_Parage_CN3_77e5a0f32e.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/5/8/csm_SP_171_Illustration_420_EXP_Lars_Weber_Spuerkeess_301b899cc5.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/8/7/csm_410_EXP_Luigi_Garofoli_Spuerkeess_6fe92987c1.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/7/d/csm_417_RSE_Max_Didier_CDCL_ac53048797.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/1/7/csm_416_EXP_Marco_Rasque_Da_Silva_Spuerkeess__1__33f3f45032.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/9/a/csm_415_EXP_Stephanie_Damge_House_of_Entrepreneurship_ef4a4a81e8.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/3/6/csm_414_EXP_Tom_Wirion_68ffad8a51.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/0/7/csm_Jessica_Thyrion_ESG_080dab77d5.png)