The ESG exclusion policy aims to explain the commitments, governance and criteria put in place within the Bank concerning ESG exclusions related to sectors and controversies. It thus documents the implementation of ESG exclusion criteria, which aims to improve our positive impact as well as to reduce our negative repercussions caused by non-financing solutions.

The activities not covered by these exclusions are:

- Clients and investors acting on a “self-execution” basis, who may continue to carry out transactions in the securities in question,

- Current accounts/deposits that the Bank will continue to accept,

- Instruments classified as sustainable1 (issued by a company whose activities would be excluded),

- Sustainable projects and financing1 (requested by a company whose activities would be excluded),

Portfolio management delegated to ODDO BHF (Private Banking).

1 Meeting ICMA/CBI standards (e.g. a Green Bond)

The ESG exclusion policy is part of Spuerkeess’ transition enabler strategy, that focuses on the environmental, social and governance issues arising from our impact analysis.

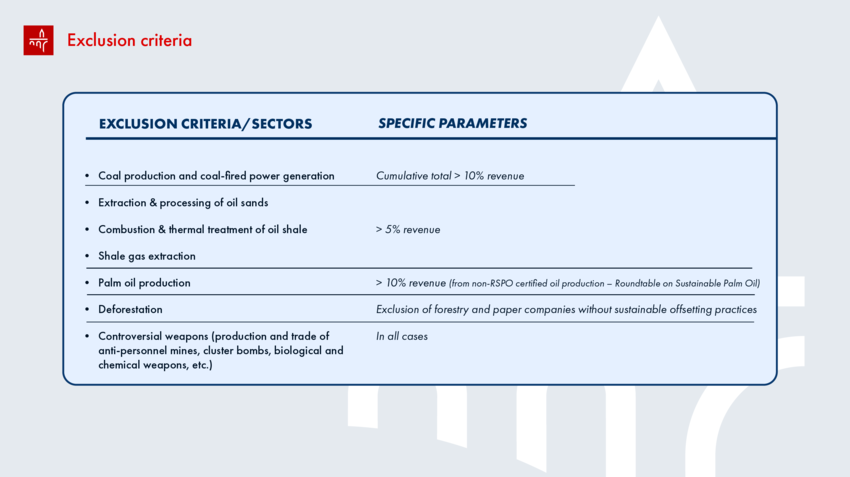

It is based on the principle of double materiality, implying the exclusion of sectors, activities and events:

- that ”significantly harm” the environment and society or generate important adverse impacts;

- that generate a high level of “sustainability risks”, in particular transition risk (impact on the Bank linked to the reputation, regulations and market trends).

The method used is based on issuer data provided by external service providers in order to cover the Bank’s financial universe.

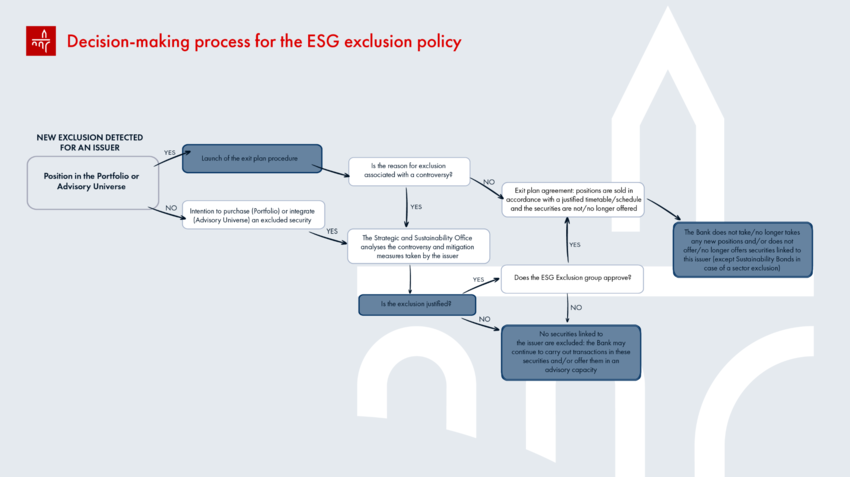

A group called “ESG Exclusion” has been created within the Bank to manage exclusions related to controversies and sectors. In case of a disagreement between the members of this group, the Bank’s second line of defence will make the final decision. The following diagram details the steps that are followed when a new exclusion is triggered by one of the criteria referred to in point VI. :

1) Exclusion rules

Sector exclusions

Excluded assets become re-eligible for investment, with no moratorium, once the issuer’s activity no longer falls within the exclusion parameters.

Controversy-based exclusions

Excluded assets become re-eligible for investment, with no moratorium, once the controversy that triggered the exclusion no longer meets the criteria. The exclusion criteria are based on assessments provided directly by our external provider and on analyses carried out by the United Nations Global Compact (UNGC).

2) Grandfathering

A “grandfathering” clause allows to take into account the situation of newly excluded counterparties for which the Bank already holds positions.

An exit plan is put in place after consulting the departments involved, as defined in the procedure, which results in a decision ranging from immediate selling the position to selling it at maturity.