Volatility: a thing of the past?

A month of renewed volatility has just come to an end on the financial markets. Although at first glance the performance of global equities over the month seems to be of no particular interest (-0,56%*), the markets were rather turbulent in November.

In just a few trading sessions, the flagship US index, the S&P 500, lost nearly 5%*, before rallying again from 21 November. It turns out that investors were mainly concerned about what the Fed would do in the end. And while the markets were convinced that it would cut its key rates by another 25 basis points in December, comments by some of its members raised doubts.

As a result, the probability of this rate cut fell to 30% before the Fed’s more dovish members returned to the spotlight to put a stop to the speculation and reassure investors once and for all.

The market’s jitters are understandable: unemployment is rising, suggesting that the Fed would be wrong to remain too restrictive and not respond.

The lack of economic data due to the US government shutdown compounded these fears. During the shutdown, several private sources (mostly ignored by the markets in normal times) showed low job creation figures, or even net job losses, adding more fuel to the fire.

In the end, order returned. Investors regained their appetite for risk after the Fed members provided reassurance, and markets resumed their rally towards new highs.

Economic growth and earnings expectations are bullish for 2026. Internationally, central banks are maintaining their dovish stance (with the exception of Japan, which is going through a period of idiosyncratic stress that is reflected in its interest rates and its currency), and governments will step up with fiscal stimulus.

In this context, a risk-on stance seems appropriate.

As a result, besides our return to equity neutrality several months ago, our recommended sector allocation focuses on cyclical, high-beta sectors such as Technology, Biotechnology, US Banks and Utilities, which are central to the energy needs related to artificial intelligence. On the bond allocation, duration is unwanted in this environment, and European debt is preferred over its US counterparts.

*Performance is calculated in EUR.

Stock markets

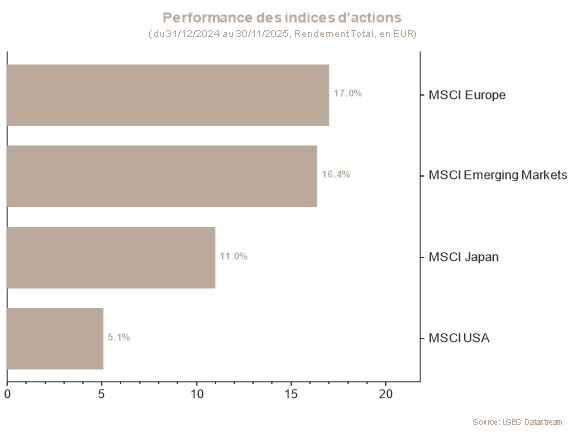

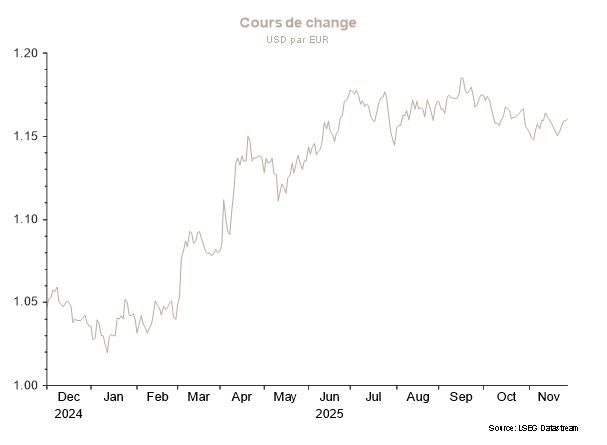

In November, the equity markets posted diverging trends: Europe advanced (+0,94%) while North America finished slightly down and China and the emerging markets posted more marked declines. Japan also fell. These trends reflect persistent doubts around AI in the United States, limited economic visibility linked to the shutdown, and persistently weak demand in China.

In Europe, the markets moved in line with diplomatic progress on the conflict in Ukraine and the political uncertainties generated by budget discussions in France. They priced in the possibility of a December rate cut in the US, although this scenario remains uncertain.

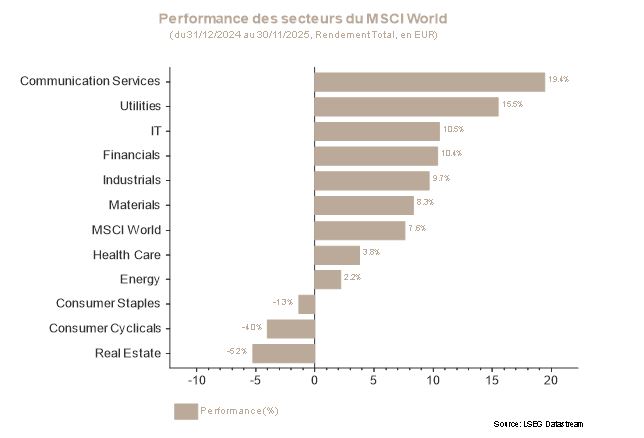

By sector, Healthcare stood out thanks to several major positive announcements: significant clinical advances in phase 3 treatments and a more favourable political climate in the United States, with agreements on the price of certain drugs. This news has improved visibility in the sector and increased investor interest in stocks with a strong pipeline.

We have increased the weight of the US in our portfolios to reflect a more bullish earnings growth profile. This increased allocation was financed by a targeted reduction on China, particularly in those stocks most exposed to domestic consumption. Our European positions were slightly reduced, particularly in Basic Materials and some German mid caps. We took profits on Communications Services and increased our exposure to Healthcare via biotechs, a good choice driven by the fact that this segment is benefitting from dynamic innovation prospects and stronger potential growth than large pharmaceutical companies, which are facing upcoming patent expiries. Biotechs are also benefiting from the integration of AI into R&D, increasing their attractiveness and positioning as potential acquisition targets. The sector therefore boasts a more promising growth profile in an environment where regulatory visibility has improved. The technology allocation linked to AI was also increased with a view to a potential end-of-year rally.

Sovereign yields and credit market

November was divided into two distinct periods. An initial period when expectations that the Fed would maintain the status quo in December increased, followed by a turnaround at the very end of the month, as economic activity and employment indicators proved less robust, prompting several Fed members to adopt a more dovish tone. This about-turn in expectations caused erratic movements on the US yield curve, before a rally at the end of the month. Indeed, the US 10-year yield ended November down 6 bp at 4,01%.

In the eurozone, movements were more limited: the 10-year Bund moved close to 2,65% and ended the month at 2,68% (+5 bp) against a backdrop of monetary policy status quo and mixed data. Short-lived fears around the German fiscal stimulus briefly pushed up the long end, while peripheral country spreads were resilient overall.

The credit segment also experienced turbulence: for investment grade (IG) debt, spreads initially widened before recovering some lost ground in a rally at the end of the month. High yield (HY) debt followed a similar trend, but volatility was higher. In the end, IG spreads stood at 83 bp in Europe (+4 bp) and HY spreads at 287 bp (+1 bp) on the last day of the month.

In short, November saw yields buffeted by the Fed’s almost-daily reassessment of its monetary easing timetable, the status quo expected from the ECB, and increased sensitivity to business and inflation indicators in the United States.