Markets remain buoyant

Investment Update - September 2025

After several months of strong performance, the equity markets ended August flat, with the global equity index posting a very timid 0.20% gain (in euros). While the main US indices have been flirting with new all-time highs, European indices are just shy of them.

As far as US indices are concerned, a real currency effect is apparent: while the S&P 500 rose by 2% in dollars, the index’s performance is actually negative once it has been converted into euros (-0.4%). Indeed, while the dollar strengthened at the end of July, it weakened in August, and the exchange rate increased from 1.14 to almost 1.17 over the month. European indices, however, rose by nearly 1% driven by southern European countries such as Italy and Spain, with France and Germany posting lower growth rates.

From an economic perspective, the data published throughout the month sent out contradictory signals. While the US job creation data published at the beginning of the month was very disappointing, other indicators such as the Purchasing Managers’ Index (PMI) delivered positive surprises.

From a market perspective, this weak job creation data was welcome. Jerome Powell, Chairman of the US Federal Reserve Bank (Fed), delivered a dovish speech at the Jackson Hole symposium, to which the most optimistic reacted by referencing the ongoing weakening of the labour market, which requires changes to monetary policy as a result of (supposedly only temporary) inflation.

That said, in the same speech, Powell also said that inflation was rising again as a result of Trump’s tariffs. A more sceptical interpretation reminds one of the 2021-2022 period when the Fed nipped looming inflation in the bud, again referring to it as “temporary”. Ultimately, successive upheavals did not stop this inflation, and the Fed has still managed to bring inflation down to its target rate.

In August, fears over employment and the prospect of less restrictive monetary policy drove US rates down: the 10-year rate started the month at more than 4.30% and ended it at 4.20%. Naturally, expectations of rate cuts were more reflected in short-term rates (for example, the 2-year rate), which dropped by nearly 30 basis points. In Europe, rates are trending differently, with relative stability at less than 2% for 2-year rates and an increase for 10-year rates, which ended the month at close to 2.80%.

This change in tone increases the likelihood of a key rate cut in the US in September. As for the other rate cuts expected by the market, the tone will be set by the next employment and inflation figures.

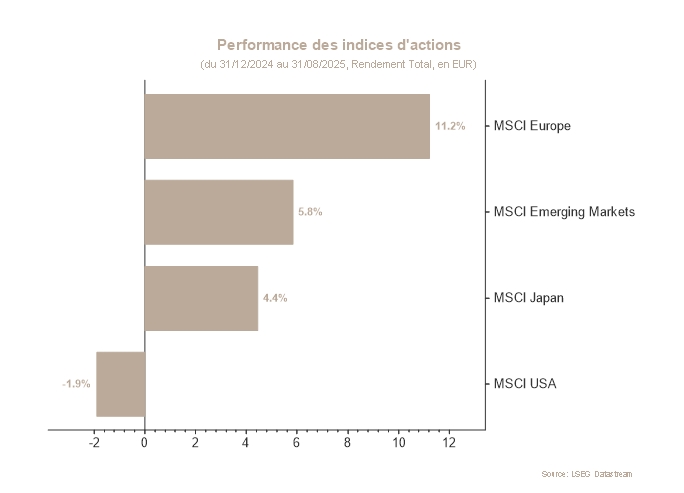

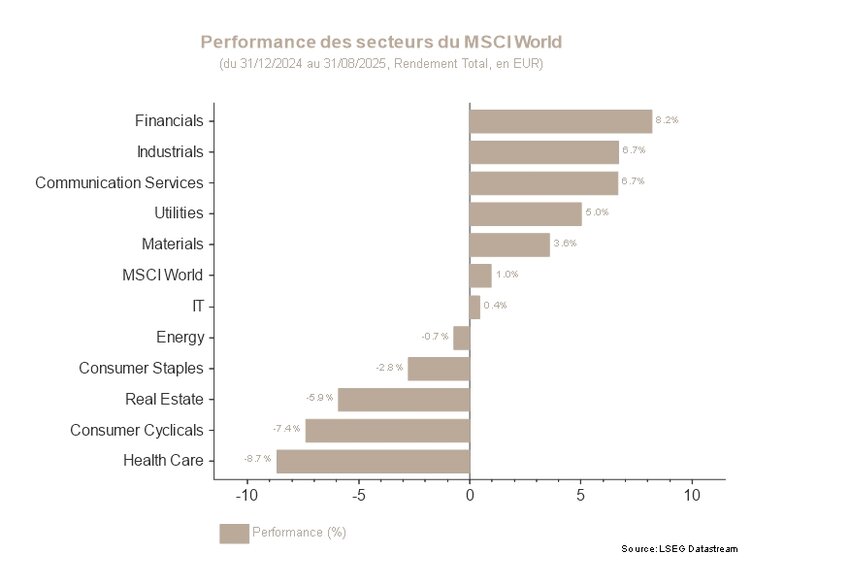

In terms of positioning, it seems appropriate to remain invested in equity markets in an environment where the Fed is supporting the economy. From a geographical point of view, the preference is nevertheless for European and emerging markets, both of which are benefiting from expansionary fiscal policy. As lower key rates imply a steepening of the US yield curve, the banking sector is likely to benefit. At the same time, the Communications Services (AI factor) and European Basic Materials sectors are still overweight.

On the bond side, duration is generally kept in line, and caution is advised regarding long-term US interest rates. High inflation expectations, fears about the Fed's independence and the budget deficit reduce the appeal of long-term maturities. In Europe, a certain stability in growth and inflation expectations argues for a duration close to that of the market. As for corporate bonds, spreads are tight but still offer decent yields.

Stock markets

Equity markets rose in August, driven by positive economic indicators and generally better-than-expected corporate earnings. Japan stood out thanks to strong data and a new trade agreement with the US.

On both sides of the Atlantic, Basic Materials performed well, while Healthcare showed signs of improvement. On the other hand, Technology underperformed, and stocks related to Utilities weighed on performance in Europe. In Real Estate, a segment that fell back last month, performance continued to lag.

In Europe, the improvement in activity was clouded by political uncertainties in France, while the UK suffered from persistent inflation and restrictive monetary policy. Emerging markets benefited from the Chinese recovery, supported by the easing of trade tensions with Washington and measures to support the technology sector. Small caps and Value stocks also performed well. At the end of August, equity allocations remained unchanged.

Sovereign yields and credit market

The fixed-income markets were particularly volatile in August. A combination of ambiguous monetary signals and mixed economic data were behind this heightened volatility.

In the US, sovereign yields experienced sawtooth growth, amid growing doubts about the Fed’s independence and the path of rates. The US 10-year rate began the month by falling sharply by 16bp to 4.22%, after a particularly weak employment report. Hopes of rapid monetary easing were revived, boosted later in the month by a July CPI that was in line with expectations. However, the momentum then partially reversed as markets became more hesitant in response to contradictory messaging from the Fed. Some warned of inflationary risks linked to tariff increases while others paved the way for a rate cut as early as September. Finally, Fed Chairman Jerome Powell adopted a dovish tone at the Jackson Hole symposium, stating that the labour market was showing “signs of increasing weakness”. This statement contributed to a further easing of rates at the end of the month, with the 10-year ending August 15bps lower at 4.23%.

In the Eurozone, the 10-year Bund remained on a moderate upward trajectory, gaining 3bps to 2.72%. However, two underlying dynamics deserve to be highlighted. On the one hand, the German 30-year rose to 3.30%, its highest level in fourteen years, driven by the rise in core inflation in the US and concerns about the sustainability of tariff increases. On the other hand, French government bonds were clearly out of favour in a tense political environment. The 10-year OAT-Bund spread soared by 13bps to reach 82bps at the end of the month, while a crucial vote of confidence in the Bayrou government is expected in early September.

On the credit side, the trend is favourable despite the political turbulence. In the US, investment grade spreads fell to their lowest level since 2007 and ended the month broadly unchanged. Their European counterparts hit new cyclical lows at 76bp, but ended the month up 6bp at 84bp.