Markets at peak levels

Investment Update - August 2025

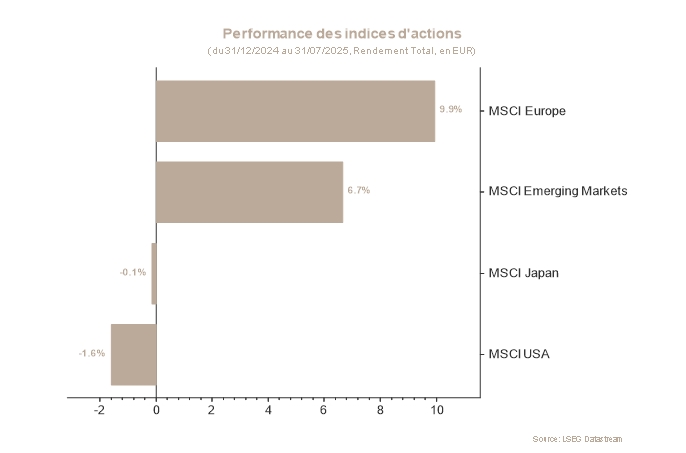

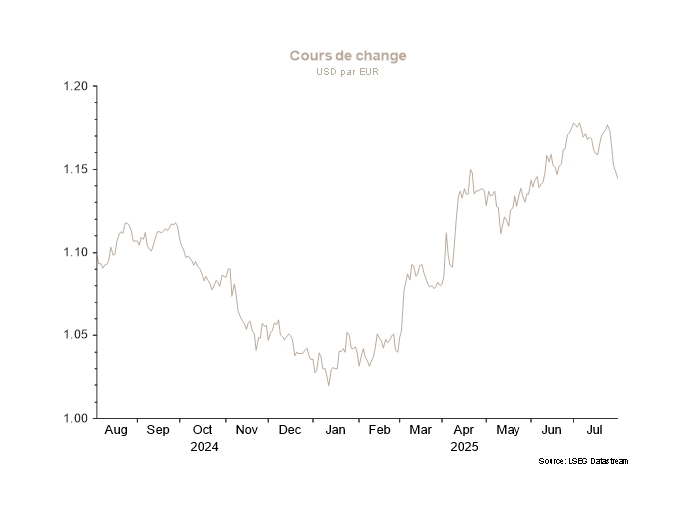

July marked another month of strong performances, with a rise of 3,95% for the global equity index. US equities made a solid comeback, delivering gains of more than 5% in euro terms, while the European indices rose by less than 1%.

On the interest rate front, movements were volatile, with the US 10-year rate rising from 4,23% at the beginning of the month to over 4,48%, before ending the month at 4,37%. Similarly, in Germany, the 10-year yield rose from 2,60% to 2,70%, although movements were more controlled.

At the global level, equities continue to hover near historic highs, posting record valuations. Once again, it is the artificial intelligence theme that is driving markets to these highs. For now, these movements remain supported by strong fundamentals.

That said, economic indicators are beginning to send early warning signs. While inflation remains below 3%, it is starting to rise again in the categories of goods affected by tariffs.

Moreover, some economic figures are starting to show signs of weakness, particularly in consumer spending and employment.

For example, in the US, real consumption levels in mid-2025 are the same as they were in December 2024, indicating that there has been no growth in this area so far this year.

In terms of employment, we are also seeing job creation stagnate, despite a persistently stable unemployment rate.

Many investors have bet on the resilience of the US economy despite the tariffs, largely because these have not yet had a noticeable impact on the economic data. However, this gamble is becoming increasingly risky as stock market indices reach new highs and the first signs of a slowing economy begin to emerge.

On the European front, the signing of a trade agreement with the US was received rather negatively. Indeed, a 15% tariff rate will now be applied to European exports to the United States, impacting—though only marginally— projected growth in Europe. Nonetheless, the European continent continues to ride a wave of optimism, driven by anticipated government spending plans combined with a stable inflation environment.

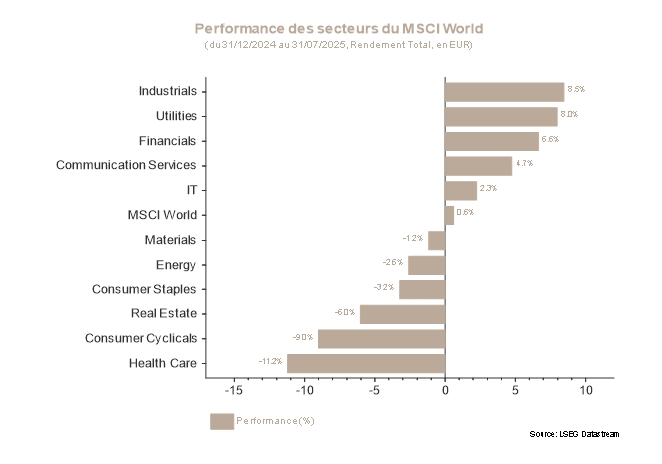

In this environment, it is advisable to adopt an underweight position in equities (particularly US equities given the heightened risk of a correction), and to favour European and emerging market equities, which appear more attractive. From a sector perspective, the preference for European Communication Services and Basic Materials remains unchanged.

In the bond segment, the expected rate cuts in the US should be moderate as inflation is likely to rise again. This calls for favouring a shorter duration on US bonds. In Europe, with the European Central Bank nearing the end of its rate-cutting cycle, a market-neutral duration appears appropriate. As for corporate debt, despite narrow spreads, yields remain attractive in the investment-grade segment.

Stock markets

Global equity markets returned to their historic highs in July, once again driven by a flurry of progress in trade negotiations. The impact of tariffs on inflation and global growth has been relatively muted at this stage, allowing markets to sustain their rally over the period. Index volatility remains very subdued, and the VIX remains below its average level despite a few rare and minor spikes. Moreover, the positive start to the earnings season on both sides of the Atlantic has refocused investors’ attention on encouraging news, highlighting the generally healthy trend in fundamentals.

The quality of second-quarter earnings reports has sparked a renewed wave of optimism, with the S&P 500 posting 10% earnings growth, driven in particular by the performances of Alphabet, Microsoft and Meta Platforms. In Europe, indices suffered from the erosion of growth prospects. The MSCI Europe dropped 1,4% as the forecast revisions were offset by the normalisation of inflation and the effective cut in key rates. From a sector standpoint, the weakness was used as an opportunity to upgrade the Materials sector, while Real Estate was adjusted to a neutral stance. Against this backdrop, US indices outperformed their European counterparts, driven by investor enthusiasm for the technology, industrial and consumer discretionary sectors. Finally, China stands out clearly, as its political agenda gains visibility and the prospect of a tariff truce with the United States begins to take shape. The MSCI China gained 9% over the period.

Sovereign yields and credit market

July was dominated by an unprecedented series of trade tensions, fiscal debates and macroeconomic surprises, affecting bond markets on both sides of the Atlantic.

In Germany, the 10-year Bund yield experienced erratic movements. It started the month at around 2,60% before peaking at 2,73% on 15 July, weighed down by a combination of fiscal concerns (including a more expansive budget proposal in Germany). The easing of trade relations between the EU and the US led to a fall in rates, with the 10-year Bund returning to 2,60% on 21 and 22 July. However, this respite was short-lived: yields quickly rebounded to 2,70% following more hawkish signals from the ECB, which tempered expectations of further rate cuts.

In the US, Treasury yields moved significantly. The 10-year yield initially rose by 25bp to reach a monthly high of 4,48% in mid-July amid strong economic data and growing doubts about the Federal Reserve’s independence, as its Chair, Jerome Powell, came under sharp criticism from the US President. The US 10-year yield then fell to 4,37% at the end of the month as uncertainties surrounding trade negotiations appeared to ease. Finally, while the Federal Reserve left its policy rate unchanged at its late-July meeting, the tone was perceived as more hawkish, pushing the prospect of two rate cuts further into the background.

Credit markets continued their rally in July, driven by renewed risk appetite, solid economic publications and progress in trade negotiations. In the Eurozone, spreads (the risk premium companies must pay to borrow) tightened significantly, reaching new lows since 2022 at 78bp in the Investment Grade segment. The High Yield segment also benefited from this favourable environment, with spreads tightening by 38bps to 272bps.