The markets are taking things in their stride

Investment Update - July 2025

After breathtaking rallies in the second half of April and May, global equity indices continued to perform well, albeit more moderately. The global index rose by 1.05% in euros.

Most investors have put the shockwaves caused by tariff announcements behind them and started buying again, pushing index valuations up.

The equity market is also riding the wave of inflation, which had previously had little effect. While some economic statistics have come out below expectations in recent weeks (real estate and retail sales in particular), the fact that inflation is still not being impacted by tariffs makes for a calmer environment for equities.

Controlled inflation has enabled members of the US Federal Reserve (Fed) to express rather dovish views on monetary policy. The Fed has paused its action for the time being and is continuing to discuss possible rate cuts in the second half of the year. That said, Fed Chairman Jerome Powell - much maligned by Donald Trump - has reiterated his cautious view and expects inflation to rise much higher due to the new tariffs.

In addition, despite the geopolitical troubles between Iran and Israel, which briefly sent oil prices soaring, investors kept their heads cool and the indices recovered as soon as prices began to ease.

Yields naturally benefited from the leniency with regard to inflation and tariffs. With the impact on inflation still not being felt, the US 10-year yield eased from 4.40% to 4.23%, and the market expects a further decline over the next 18 months.

In Europe, the German 10-year sovereign yield rose slightly from 2.49% to 2.61% against a backdrop of military and infrastructure spending plans. At the same time, inflation is under control in Europe and is not putting any upward pressure on yields.

Meanwhile, the foreign exchange market remains volatile. The dollar continued to weaken against the euro, more sharply so in June, falling from 1.14 to 1.18. The lack of political visibility in the US and a certain willingness by the US administration to allow the dollar to weaken to increase productivity are not helping to improve the outlook for the greenback.

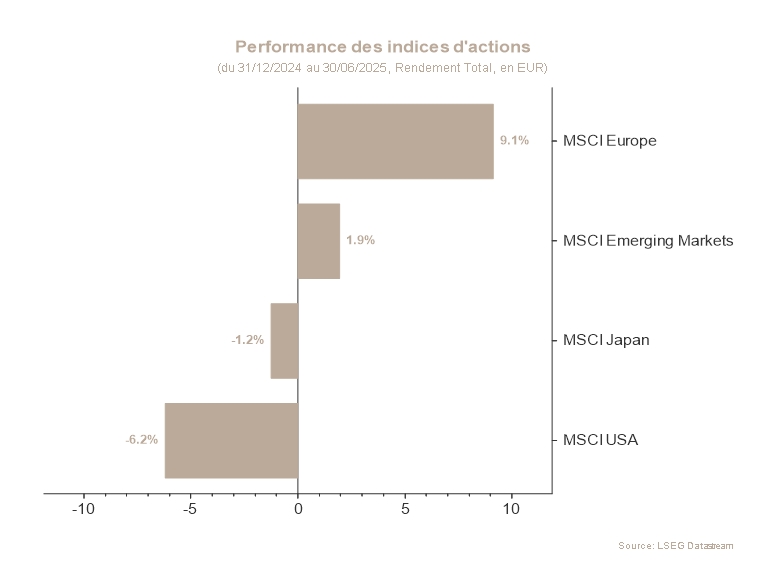

This weakening in the dollar inevitably had an impact on portfolio performance. While US equities had gained 5% in US dollar terms at the end of the month, the European investor pocketed “only” 1.35%. Admittedly, this is better than the performance of -1.30% on the European indices, but the effect is nonetheless significant.

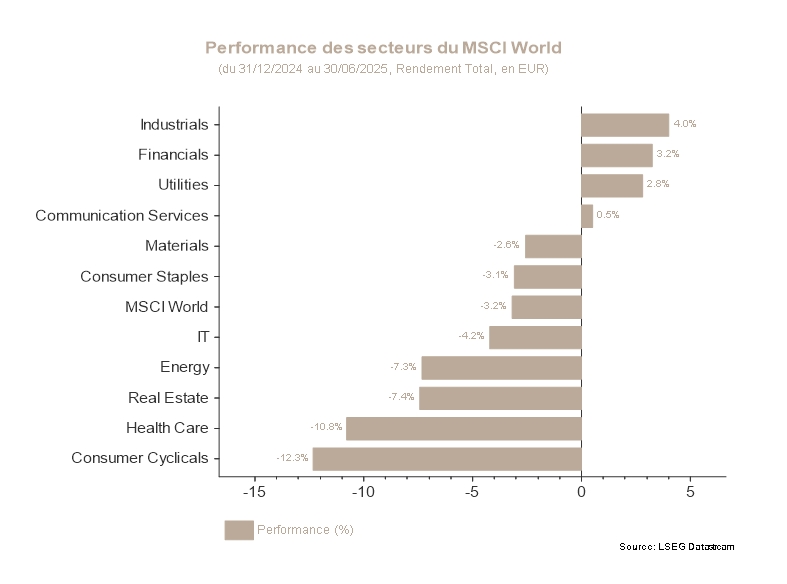

Overall, our recommended allocation is moderate. US equity markets are trading with high valuations, adding to their vulnerability. US politics is still a risk factor and has inspired international diversification: Europe is benefitting as it retakes control of its destiny while emerging countries are benefitting from a weaker dollar. In addition to high valuations, the risks on the dollar reduce visibility on the US market.

From a sectoral point of view, Communications Services remains in favour, particularly companies exposed to the AI theme. In addition, the European real estate sector, which has been overweight for several months to take advantage of the fall in key interest rates in Europe, is being replaced by the Basic Materials sector, which is deemed likely to benefit from government spending plans in Germany, particularly in infrastructure and defence.

In fixed income, extending duration remains unattractive unless a recession looks likely. However, on corporate debt, duration remains close to that of the market with priority given to carry and quality.

Stock markets

June was dominated by rising tensions in the Middle East. Israel has stepped up its operations against Iran, with the support of the United States, which has carried out targeted strikes against Iranian nuclear facilities. However, the markets remained resilient. A rapid ceasefire, a measured response and signs of de-escalation have calmed fears of widespread conflict. In this tense environment, oil prices and volatility eased after rising briefly.

Economic concerns are returning to the forefront. Trade negotiations with Europe, China and Canada are continuing calmly. It would appear that the outcome is close and that the matter will be resolved by US Labor Day on 1 September.

However, the equity markets held up well. In the US, the S&P 500 and Nasdaq reached record highs, driven by expectations of rate cuts, a weak dollar and solid corporate earnings. In Europe, performance was more modest. The Stoxx 600 fell slightly, but flows into European funds turned positive again, concentrated on ETFs. The Energy, Technology and Construction sectors performed well, while defensive stocks underperformed.

In short, despite an explosive geopolitical climate, the markets showed resilience by focusing on economic and monetary fundamentals.

Sovereign yields and the credit market

While international trade has been in the spotlight since early April, investors focused their attention on the major escalation in geopolitical tensions in June.

In Germany, the 10-year government bond yield started the month at 2.49% and ended the month at 2.61%. In net terms, geopolitical tensions in the first half of the month had relatively little impact on German yields, with the turmoil quickly giving way to a ceasefire and US yields pulling European rates in their wake. However, there was an upward trend in German yields at the end of the month. The speed with which the German government wants to commit spending to its structural plan came as a surprise. As a result, the borrowings needed in the second half of the year were revised upwards, as were growth and inflation expectations for the coming years.

In the US, the 10-year yield was volatile in the first half of the month. Yields were sensitive to economic data and their implications for the health of the US economy. With these figures sending conflicting signals, yields fluctuated between 4.35% and 4.50%. In the last part of the month, relatively dovish comments from Fed members dragged rates down, with investors expecting more interest rate cuts. The US 10-year ended June at 4.23%.

The corporate debt markets fared well and the rates that businesses have to pay to borrow (spreads) declined further. Rates for healthy investment-grade companies fell by 0,08% to end about 1% above government rates. For riskier companies in the high yield category, the decline was less pronounced (-0,02%) but rates remained relatively low.