The leaves are falling but the markets are rising

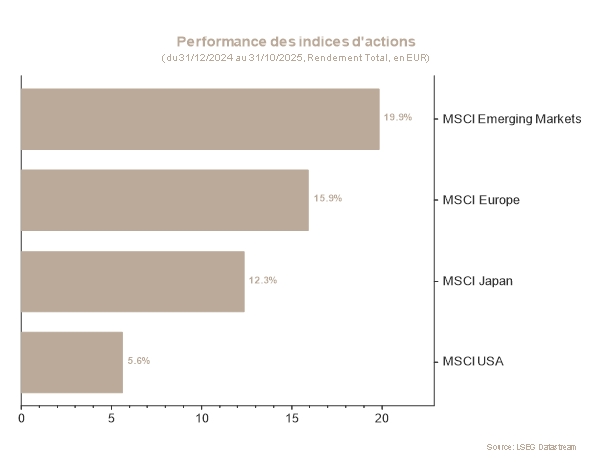

October followed tradition with equity markets recording considerable gains of more than 4%*. The performance came mainly from the US and emerging markets, which gained 4,11%* and 6,06%* respectively, while the European markets rose more modestly, by 2,54%*.

From an economic point of view, the key event this month was the US government shutdown due to the lack of cross-party agreement on financing. As a result, most economic data from US public institutions could not be published. Only inflation - the consumer price index - was released. Although inflation remains high, it is showing little volatility, and economic players are confident that it will return to the 2% target (albeit more slowly). The data showed that in September, inflation stood at 3% year-on-year, compared with the consensus of 3,1%. It is clear that inflationary pressure caused by tariffs is weighing on a few categories of goods, but this is expected to ease over the course of 2026, allowing inflation to return to the 2% target.

The monetary policy decisions of the US Federal Reserve (Fed) and the European Central Bank (ECB) were also two highlights of the month.

While the ECB is pleased with the current stance of its monetary policy and naturally opted for the status quo, the Fed cut rates by a further 25 basis points. That said, its Chairman, Jerome Powell, took the opportunity offered by his press conference to calm investors who are hungry for further rate cuts. While before Powell’s speech, the market thought that a further cut in December was certain, the bond market revised its opinion and the probability of a third consecutive rate cut now stands at just 50%.

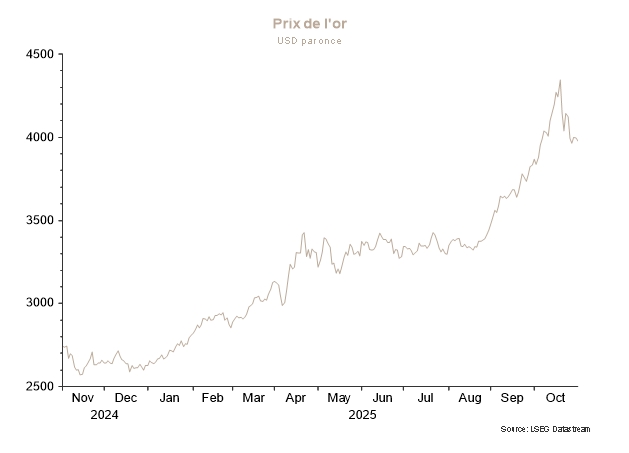

We cannot ignore the high volatility in precious metals markets, particularly gold. While the price of gold climbed to $4.400 per ounce in October, it lost more than 10% in the space of a few days, falling back below $4.000. A similar but more pronounced movement took place on silver, which continued to rise in the first half of the month before losing more than 13% in the second half.

Before we conclude, we also need to mention that the issue of trade tensions is back on the agenda. While substantive issues remain unresolved, the Trump-Xi meeting was a success and common ground was found on tariffs, rare earths, fentanyl and US soybean exports to China.

In conclusion, investors’ appetite for risk continues to push equity markets to new unexplored highs. In addition to the macroeconomic environment, which is stabilising following the upheavals linked to tariffs, corporate earnings and the Fed's rate cuts are restoring investor confidence. That said, high valuations, particularly in US markets, could allow volatility to return and provide new market entry points.

At present, neutrality between equities and bonds seems justified. A geographic bias favours Europe and emerging markets, which have relatively more attractive valuations.

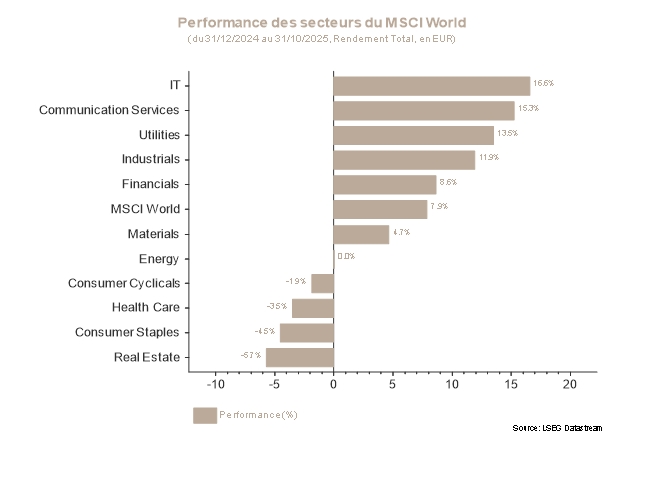

In terms of sectors, Communications Services, Utilities and Chinese Technology provide our portfolios with appropriate exposure to the artificial intelligence theme. In addition, the overweight position in large US banks provides exposure to the deregulation pushed by the Trump administration and a possible steepening of the US yield curve. Lastly, Basic Materials in Europe are overweight to benefit from the cyclical rebound promised by public spending expectations in Germany.

*Performance is calculated in EUR.

Stock markets

In October, global equity markets continued their rise, driven by the earnings momentum of large technology stocks and the more accommodative monetary policy environment.

In the United States, the period ended with a sixth consecutive month of gains for the S&P500, which posted a new performance record, closing up 2,4%, boosted by flagship Tech and AI publications. The Nasdaq recorded its seventh month of gains and ended October up 4,81%, still driven by AI.

In the eurozone, the trend was positive but more measured: the EURO STOXX 50 added +2,54% over the month, peaking at the beginning of the period and then consolidating.

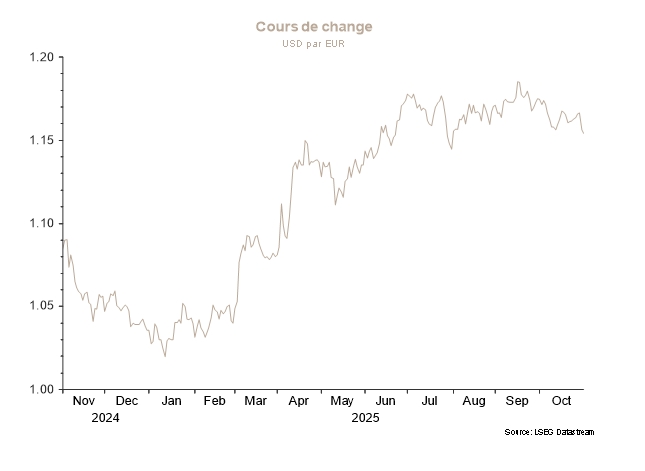

Emerging markets’ performance was mixed, with Asia ex-Japan suffering from areas of weakness linked to China, while other EM segments continued to perform well thanks to the softer dollar and support from commodities.

By sector, Technology and Communications Services outperformed significantly, driven by earnings guidance from AI firms and rising capex for cloud service providers (AWS, semiconductors).

Amid high valuations, the allocation to the Utilities sector was increased in order to profit from the rise in electricity demand linked to data centres. Conversely, the allocation to the Consumer Staples sector was reduced due to its low margins and sensitivity to tariffs.

Sovereign yields and credit market

October saw successive periods of volatility triggered by monetary policy uncertainty, trade tensions between Washington and Beijing and the political situation in Europe.

In the US, the Fed cut its key rate by another 25 basis points, bringing the target range to 3,75%–4,00%. While this decision was widely anticipated, Jerome Powell’s tone was more cautious, highlighting growing divergences within the committee and suggesting that a further cut in December was not a given. In addition, the Fed announced that its quantitative tapering (QT) would come to an end on 1 December, a move perceived as slightly accommodative. Against this backdrop, yields fell in the first half of the month before recovering somewhat at the end of the month following the Fed's statement: the 10-year yield ended October at 4,08%, down 7bp.

In the Eurozone, the ECB kept its monetary policy on hold for the third time in a row, believing that the current level of interest rates offered an appropriate balance between supporting growth and controlling inflation. The 10-year Bund fell by 8bp to 2,63%, while peripheral bonds generally held up well. France remained under pressure in a context of political turmoil and a downgrade of its sovereign rating, before stabilising at the end of the month: the OAT-Bund spread narrowed from a peak of 86bp to around 79bp.

On the credit side, the markets dipped in mid-October in the wake of concerns about the US banking sector, before rebounding against a backdrop of renewed risk appetite and favourable issuance conditions. On average, Investment Grade spreads narrowed slightly over the month in Europe (-2bp to 76bp) and widened somewhat in the United States (+4bp to 78bp).