A busy fall ushers in a fresh start

Investment Update - October 2024

September ended in positive territory on the stock markets, after a period of quite extraordinary volatility throughout August.

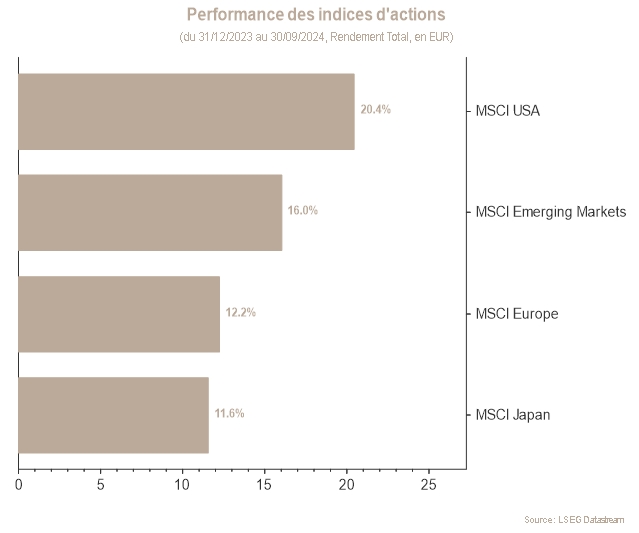

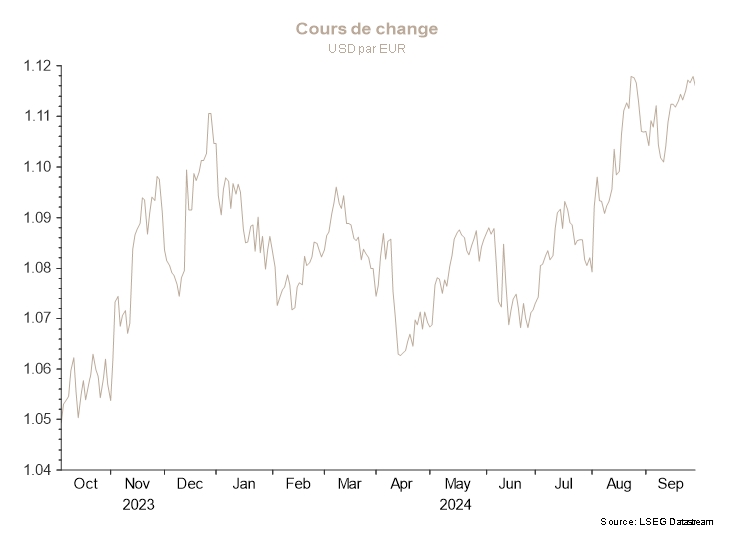

Global equities thus gained nearly 2% in euros, driven by emerging markets and, more specifically, China, whose performances rose by 8% and 30% respectively, boosted at the end of the month by government announcements aimed at supporting the real estate market.

As for developed markets, the United States still led the way, posting a performance of 1,3%, while the European market’s performance dropped 0,7%.

September was a month rich in data and events for the economy and central banks.

Despite the recurring alarmism about the health of the US economy, growth in the second quarter was confirmed at 3% in real terms. The details of this third revision of GDP growth are even more encouraging, as gross national income has been revised significantly upwards: rising from 1,3% to 3,4% growth, it has caught up with GDP growth. Thus, the resulting savings rate is higher (5% vs. less than 3% previously) and reassuring with regard to US consumer health.

In Europe, economic figures are less encouraging. In particular, confidence indicators remain lacklustre. Industrial production is not increasing, in line with profit warnings from car manufacturers. However, this gloomy picture does not prevent excellent news: inflation fell below 2% for the first time since 2021, paving the way for more rate cuts by the European Central Bank (ECB).

For its part, China is finally acting to stop the waning confidence in its real estate sector by implementing numerous measures announced at the end of September: lowering interest rates, increasing household purchasing power and regulating the market to put an end to the fall in prices, which would allow households to stop saving and revive the economy. Indeed, over the past two years, real estate prices have plummeted in China, particularly affecting households that have ended up saving and buying gold.

For central banks, the time for rate cuts has arrived. The US Federal Reserve (Fed) began its cycle with a “surprise” rate cut, compared to historical precedent, of 50 basis points, in order to address a possible deterioration in the labour market. Meanwhile, the ECB, which is more cautious in its approach, has cut rates by 25 basis points every other meeting since June. But it seems to be worried about lagging behind, given the weak economic data and the speed at which the Fed is cutting rates.

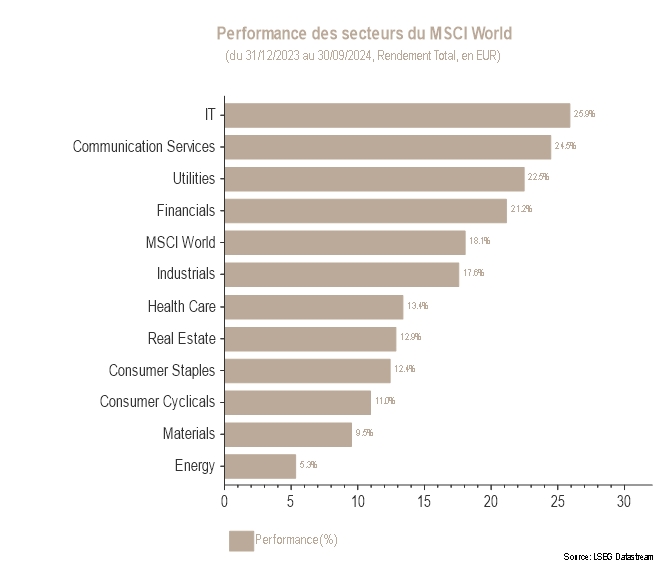

Strategically, it seems appropriate to take a wait-and-see approach to the US elections in November. Historically, the weeks leading up to elections have been synonymous with volatility in the financial markets. This could be exacerbated by the recent tensions that have returned to the forefront in the Middle East. That said, economic and financial fundamentals remain strong. Therefore, although equity neutrality remains preferable in the short term, the support that central banks are likely to provide is not an element to be underestimated. Thus, buying equities during volatile phases could prove to be an attractive risk if this volatility materialises. Meanwhile, the carry provided by sovereign and corporate bonds seems attractive in this phase of monetary policy easing. In terms of sectors, the artificial intelligence theme remains a priority, even though the recent sector rotation in favour of Value has made positioning difficult. Finally, it seems appropriate to refine this offensive position via the Healthcare sector, which offers some stability in terms of profits.

Stocks markets

US markets outperformed their European peers in September. Oil prices fell, making Energy the worst performing sector. Healthcare and Financials struggled, while Consumer Discretionary and Utilities were the top performers in the US, and Real Estate outperformed in Europe. Chinese stimulus measures also led to gains for Chinese ADRs in the US.

The allocation remains adapted to a soft landing scenario for the global economy, with the focus on the Technology, Communications Services and Healthcare sectors, while caution remains the watchword on the Basic Materials sector due to uncertainty about the trajectory of global demand. From a more tactical point of view, the allocation to the Energy sector was increased in view of the geopolitical situation in the Middle East, as was the allocation to China, after its announcements at the end of the month. At the same time, given that economic activity is not picking up in Europe, the allocation to European Small & Mid Caps was reduced.

Sovereign rates and credit market

In September, sovereign rates continued to fall in the United States and in Europe. The 10-year yield fell by 12 basis points (bp) and the 2-year by 27 bp. In Germany, the 10-year lost 17 bp and the 2-year lost 32 bp. Yield curves remain inverted but much less pronounced than they were. For the first time since 2022 in the US and Germany, yield curves have normalised, with the 10-year rate higher than the 2-year rate.

In the United States, most of the downward movement took place in the first half of September, with the 2-year rate hovering around 3,50% for the rest of the month, and the 10-year rate rising from 3,6% to 3,8%. Indeed, at the beginning of the month, various economic indicators revealed a weakening labour market and Manufacturing sector. In addition, several central bankers highlighted the progress of inflation towards the Fed’s target. These factors supported investors’ expectations of key rate cuts in 2024 and over the next 12 months, pushing US rates down. After fierce debate among investors on the extent of the Fed’s first rate cut, the institution cut its key rate by 50bp in mid-September. However, more favourable economic data and comments from central bankers at the end of the month boosted confidence in a soft landing scenario in which the Fed can afford to act without haste.

In Europe too, most of the rate movement took place in the first half of the month, ahead of the last ECB meeting. Indeed, the fixed income markets in the United States and the weakness of the Manufacturing sector in Europe strengthened expectations of the many key rate cuts foreseen in the coming year. Moreover, the ECB cut its key rate by 25bp for the second time this year and conveyed a slightly less accommodative message than expected, without providing any indication as to the pace of future cuts.

The credit market ended with a positive performance at the end of September, largely supported by the movement in rates. Spreads initially rose under the pressure of high issuance volumes and uncertainties about some issuers in the Automotive sector. However, spreads ended the month with no major movements.

Despite the recent volatility in rates, we recommend keeping duration close to that of the market.