A tailor-made investment

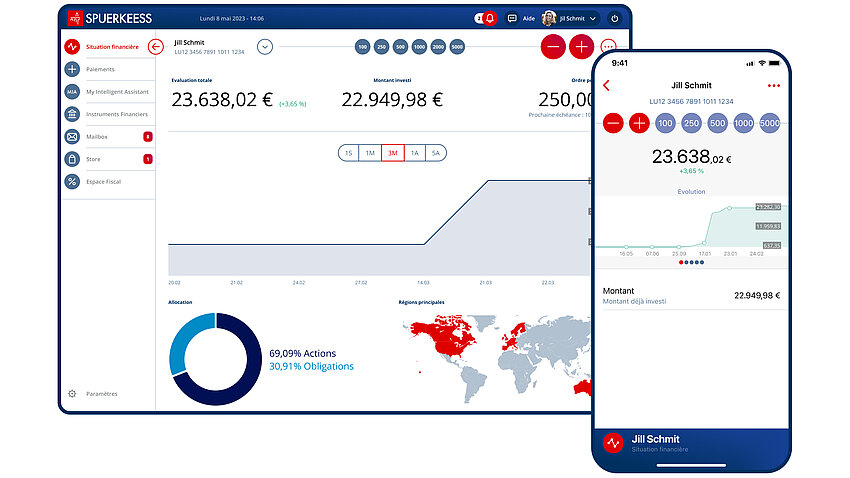

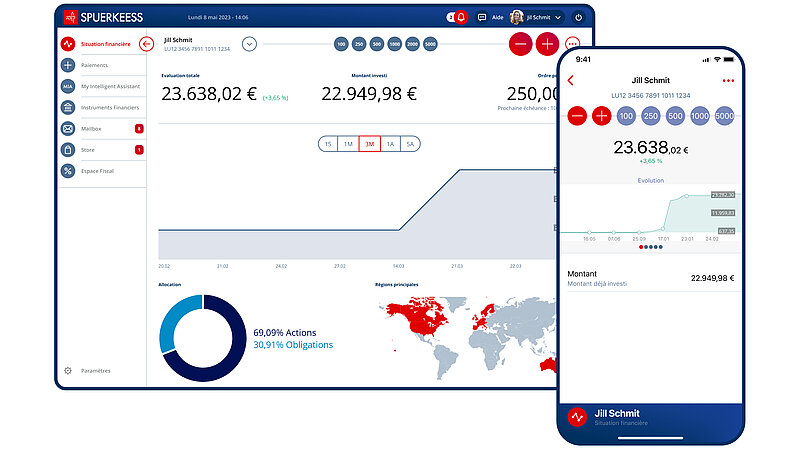

Speedinvest takes into account your goals and your financial situation.

No need to be an expert in financial markets. Answer a few easy questions and Speedinvest suggests a personalized investment plan.

Max. 80% Shares

Min. 20% Bonds

If you accept a high risk exposure and seek an increased positioning in the equity market, a dynamic strategy is the right choice for you.

Max. 50% Shares

Min. 50% Bonds

If you accept a moderate risk exposure and seek a balanced position in the equity and bond markets, a balanced strategy is the right choice for you.

Max. 20% Shares

Min. 80% Bonds

If you prefer a low exposure to risk and seek an increased positioning in the bond market, a cautious strategy is the right choice for you.