Unrivalled flexibility for your peace of mind

Luxfunds Portfolio Strategic Allocation offers innovative, flexible, diversified management that complements traditional management strategies. Our investment process is based on an approach of ongoing evolution to offer you a multi-strategy and multi-thematic solution at any time, adapted to the current market environment (such as the recent resurgence of inflation).

Our approach is based on:

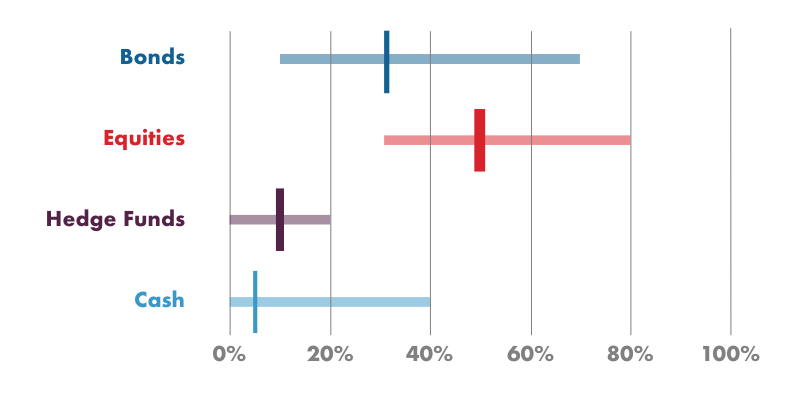

- Long-term strategic management: Carefully balanced exposures to equities, bonds, hedge funds and currencies, tailored to each investor’s risk profile.

- A medium-term cyclical allocation: Proactive adjustment of the portfolio according to market cycles, in order to capture opportunities and minimise risks.

- Short-term tactical adjustments: Tools such as duration management or liquid derivatives help absorb market shocks and preserve the value of the portfolio.

Global expertise, local trust

Spuerkeess & Edmond de Rothschild

To strengthen our commitment, Spuerkeess Asset Management has worked in collaboration with Edmond de Rothschild Asset Management, a world-renowned leader in asset management, to bring their exclusive expertise to bear on a unique fund in our range.

This fund stands out for its flexible investment strategy, drawing on the unrivalled expertise of Edmond de Rothschild Asset Management to adapt to market changes in a dynamic manner.

This collaboration combines Spuerkeess Asset Management’s solid management framework with the specialised knowledge of Edmond de Rothschild Asset Management, creating a unique investment opportunity for those seeking a diversified global allocation with a focus on agility and performance.

There is no guarantee that the investment objective will be achieved, nor that a return on investment will be realized. The products do not benefit from any guarantee to protect the capital. You may not recover the full amount of your invested capital.

For any explanation or definition of the terms used in this content, please refer to the glossary at the following link: Glossary.

This site is a promotional communication related to LUXFUNDS and LUX-PENSION, investment companies with variable capital (SICAV) under Luxembourg law, governed by Part I of the law of December 17, 2010, qualifying as Undertakings for Collective Investment in Transferable Securities (UCITS).

This site is published by Spuerkeess Asset Management, authorized as a UCITS management company in Luxembourg and supervised by the Commission de Surveillance du Secteur Financier (CSSF) – Registered office: 19-21 Rue Goethe, L-1637 Luxembourg – CSSF number: S00000615 – LEI: R7CQUF1DQM73HUTV1078.

Before making any investment decision, investors should read the Prospectus, available in French, as well as the Key Information Document ("KID"), available in the official languages of Luxembourg. The KIDs, the Prospectus, pre-contractual SFDR information, as well as annual and semi-annual reports, are available free of charge at the following link: annual and semi-annual reports or upon request to the Management Company. The Management Company may decide to cease the marketing of the Fund.

A summary of your rights as an investor and information on access to collective redress mechanisms at both the Union and national levels in case of disputes are available in one of the official languages of Luxembourg at the following link: Summary of Investors Rights.

This site is not intended to provide investment, tax, accounting, professional, or legal advice and does not constitute an offer to buy or sell the fund or any other financial instrument that may be presented. Past performance or performance objectives are not indicative of future performance. Future performance is subject to taxation, which depends on the individual circumstances of each investor and may change over time. This site is not intended to provide investment, tax, accounting, professional, or legal advice and does not constitute an offer to buy or sell the fund or any other financial instrument that may be presented. Past performance or performance objectives are not indicative of future performance. Future performance is subject to taxation, which depends on the individual circumstances of each investor and may change over time.